Canada is known for its high standard of living and relatively generous social welfare programs—you know the jokes about our “free” health care? However, income disparities still exist, and some Canadians struggle to make ends meet. Understanding the average income in Canada can give us insight into how our fellow citizens are doing financially.

Examining the average income in Canada can also help us understand broader economic trends and how the insurance industry is impacted. In this article, we will explore the current state of income in Canada in each province, which industries pay the least and most, what factors influence how much Canadians earn, and how Canadians can protect their hard-earned income.

What is the average income in Canada?

The median income in Canada is $68,400, after taxes, according to Statistics Canada‘s income survey (2021). This means Canadians’ average monthly take-home pay is $5,700.

The average household income of Canadians was heavily impacted by the Covid-19 pandemic, which saw many lose their jobs and an increase in the poverty rate. In 2021, 7.4% of the population, or approximately 2.8 million Canadians, lived below the poverty line, up from 6.4% in 2020.

Average annual salary will differ depending on your household makeup. For example, the average median income of families with two parents and children was $115,700, whereas a single-parent household had an average salary of $46,500.

In general, the average income in Canada will fluctuate and change depending on factors such as location, occupation, economic sector conditions, and gender.

Let’s break it down by province first.

Average Income by Province

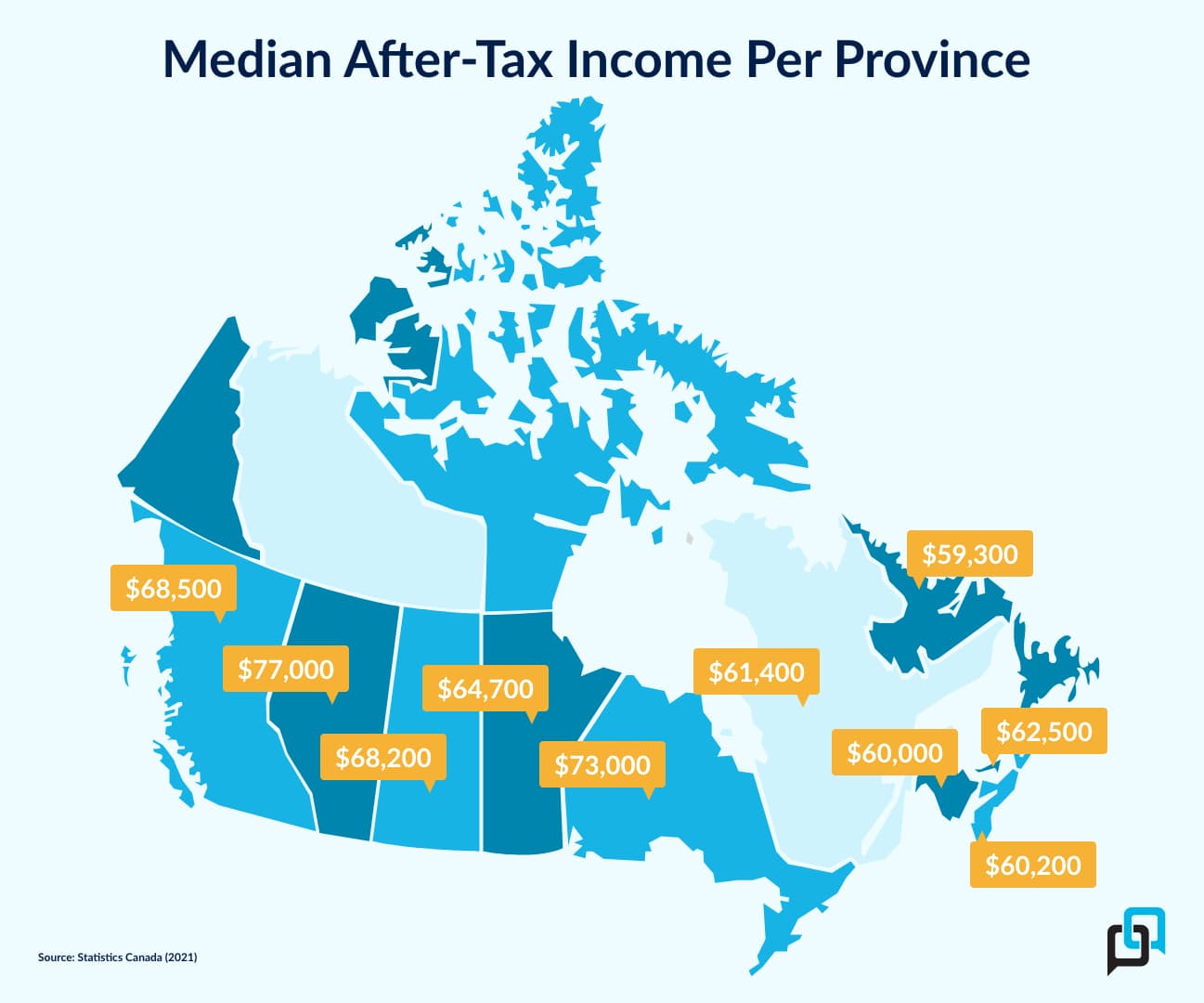

Alberta and Ontario have the highest annual salary average (Stats Can, 2021). The Canadian income distribution from province to province works out as follows:

- British Columbia – $68,500

- Alberta – $77,000

- Saskatchewan – $68,200

- Manitoba – $64,700

- Ontario – $73,000

- Quebec – $61,400

- New Brunswick – $60,000

- Nova Scotia – $60,200

- Prince Edward Island – $62,500

- Newfoundland and Labrador – $59,300

Source: Stats Canada

Gender Income Gap in Canada

Unfortunately, there is still a gender pay gap in Canada. On average, women earn 89 cents for every dollar earned by men (Stats Can).

| Female average income 2021 | Male average income 2021 |

| $46,100 | $62,000 |

While the gender income gap has slowly decreased over time, the 2021 World Economic Forum calculated that it will take 268 years to close the income inequality gap globally.

Average Income by Age Group

Income inequality also exists when it comes to age. Generally, younger Canadians earn less than older Canadians due to less experience and time in the workforce. According to Statistics Canada, the average income for those aged 15 to 24 is $15,784, while those aged 55 and over earn an average of $63,652. However, as Canadians continue to age and move into retirement, their income tends to decrease again — of course, that depends on how much they had saved.

When looking at income in Canada, it’s important to consider other factors like education and experience. Those with higher levels of education tend to earn more than those without a university degree. For instance, Statistics Canada reports the average income for those with a post-secondary certificate or diploma is $59,500 – that’s almost double the national average for those with only a high school diploma. Similarly, having more job experience can also impact your earnings – workers between the ages of 35 and 64 tend to earn more than their younger counterparts due to their increased knowledge and expertise in their field.

How much do Millennials make?

Millennials, those in the 25 to 39 age bracket, are the largest generational group in the Canadian workforce. According to the 2021 Stats Can income survey, the average pre-tax income of millennials is $51,000. This is slightly lower than the national average of $68,400 after taxes.

The reasons why Millennials are earning less than their predecessors may vary. Job opportunities have changed since the last generation, with many jobs becoming more specialized, meaning fewer people can do them. Technology has also put a damper on job growth — many jobs that were once done by people are now automated. Furthermore, wages for certain jobs have not kept up with inflation, and overall job security has decreased significantly—with fewer full-time positions available and more part-time and contractual work.

Other factors could be at play too. Millennials tend to prioritize different values in their career paths than older generations did — such as having an impact on the world, taking advantage of flexible hours or working from home, and having work/life balance rather than solely focusing on salary.

Finding a well-paying job is also key when determining overall income levels. Some industries pay better than others.

What are the highest-paying job industries in Canada?

Canadian income statistics report that the highest-paying occupation in 2020 was a specialist physician, with an average salary of $303,400. Other highly-paid occupations with large annual incomes include:

- Dentists ($175,000)

- Mining and quarrying supervisors ($97,021)

- Chief executives and senior managers ($96,270)

- Financial managers ($93,875)

The highest-paying industry in Canadian provinces or territories varies slightly from one another. For example, Alberta is known for its oil and gas extraction sector, which offers some of the highest average daily wages in the country. Meanwhile, information technology has the highest-paying average wages in Ontario, with average earnings of around $83,500 per year.

Lowest-paying jobs in Canada

In general, Canada’s lowest-paying sectors are industries that host part-time, hourly-wage positions. These are often minimum-wage positions in the following industries:

- Foodservice

- Hospitality

- Sales support occupations

- Retail

- Recreation

- Entertainment

Canadian Minimum Wage

As of April 1, 2023, the Canadian federal minimum wage increased to $16.65 per hour. According to the news release from Employment and Social Development Canada, “this increase will help make life more affordable for approximately 26,000 Canadian workers who earn less than the current rate.”

Each province has its own minimum wage standards as well. In the case that the territorial or provincial wage is less than the federal amount, the employer must pay the higher amount.

Minimum Wage by Province

| Province | Hourly Minimum Wage |

|---|---|

| British Columbia | $15.65 |

| Alberta | $15 |

| Saskatchewan | $13 |

| Manitoba | $14.15 |

| Ontario | $15.50 |

| Quebec | $15.25 |

| New Brunswick | $14.75 |

| Nova Scotia | $14.50 |

| PEI | $14.50 |

| Newfoundland & Labrador | $15 |

| Northwest Territories | $15.20 |

| Yukon | $16.77 |

| Nunavut | $16 |

| Canadian Minimum Wage | $16.65 |

The average hourly wage for a Canadian household was $36.28 in 2020 for full-time workers.

What is the cheapest province to live in Canada?

The cheapest provinces to live in Canada include Quebec, New Brunswick, and PEI. Here is a breakdown how Canadian’s spent their income including housing, food, transportation, and total for all kinds of spending in each province (excluding the territories) as of 2019*:

Household Expenditures (2019)

| Province | Housing | Food | Transportation | Average expenditure per household |

| British Columbia | $23,874 | $10,639 | $14,259 | $102,091 |

| Alberta | $22,591 | $11,322 | $15,632 | $112,317 |

| Saskatchewan | $19,436 | $10,428 | $14,039 | $95,951 |

| Manitoba | $17,411 | $9,957 | $13,185 | $90,617 |

| Ontario | $22,364 | $10,418 | $12,828 | $97,385 |

| Quebec | $15,821 | $9,847 | $10,492 | $79,639 |

| New Brunswick | $13,696 | $9,484 | $12,587 | $76,639 |

| Nova Scotia | $16,028 | $9,077 | $11,300 | $81,229 |

| PEI | $14,048 | $9,231 | $11,895 | $75,249 |

| Newfoundland & Labrador | $14,417 | $9,435 | $12,463 | $81,444 |

| Canadian Average | $20,200 | $10,311 | $12,737 | $93,724 |

Source: Stats Can

It’s important to note that this table is pulled from the most recent available data (2019). This data does not account for events of the 2020 Covid-19 Pandemic that would have affected the cost of living or the most recent increased inflation rate of 4.4%. Regardless, the cost of living takes up a majority of Canadians’ average incomes.

If the average single annual salary in Canada is $68,400 (2024) and the average cost of living is $93,724, that means those living in a dual-income household have roughly $43,000 left over. But again, that’s a rough calculation that does not consider 2024’s cost of living.

What do Canadians spend most of their income on?

When we look at the most recent statistics about how Canadian families (dual income) spend their money, it becomes clear that two major areas dominate their expenses.

Housing

$20,200

Food

$10,311

With roughly $30,000 being spent just to basically stay alive, that leaves roughly $106,800, if we presume this household has two income earners with the average single person income ($68,400). The $106,800 from the after-tax household income would be spent on other necessities such as:

- Transportation

- Clothing

- Extended healthcare

- Communication

The Fraser Institute also notes that Canadian households that make around $90,000 will spend an average of $39,000 on taxes.

Another interesting fact: From the 2019 survey, it was reported that a Canadian household spends approximately $5,297 of their yearly income on personal insurance payments and pension contributions.

Disposable Income Rates Across Canada

The average disposable family income in Canada was $33,385 in 2019. This figure has been increasing steadily in recent years, with disposable income growing by 3% between 2018 and 2019. The growth in disposable income can be attributed to factors such as increased employment rates, higher wages, and government initiatives such as tax cuts and benefits.

Disposable income refers to the amount of money that individuals have after taxes and other necessary expenses have been deducted. It is an essential factor in determining the purchasing power of individuals and the overall economic growth of the country. The cost of living also plays a critical role in determining disposable income.

Several factors influence disposable income in Canada. One of the most significant factors is the state of the economy. When the economy is strong and growing, wages tend to increase, and employment opportunities become more abundant. This results in higher disposable incomes for individuals.

How to protect your annual income with insurance

We Canadians are definitely feeling financial pressure from rising housing costs and inflation. Now, it’s more important than ever to make smart decisions with our money to make sure our family’s financial future is protected. Here is what you can do to protect your yearly income:

Disability Insurance

Disability insurance is a product that replaces some of your income if you become disabled and cannot work. The insurance company that offers you the coverage typically agrees to replace 60 to 85 percent of your regular weekly wages, regardless of whether the loss of your earning ability was due to a sudden accident or a degenerative illness. This ‘benefit’ payment is made to you until you return to good health (i.e. resume working) or until the end of your disability coverage period – whichever comes earlier, of course! The monthly or weekly benefit payment is potentially tax-free, but more on that later.

Critical Illness Insurance

Critical illness insurance is an agreement with a life insurance company where they pay you a tax-free lump sum in the event you contract a life-threatening condition or illness. This protects your family’s income that would otherwise be eaten away by costs associated with being diagnosed with a critical illness. For example, travel costs to medical facilities, home retrofitting for your condition, extra nursing, or anything else you need while you are sick.

Life Insurance

Life insurance won’t protect your income while you’re alive. However, it will protect your family’s continued financial stability. A life insurance payout can make up for the monthly salary your family will miss out on if you were to pass away. The death benefit from a life insurance policy is an income tax-free payment that your family can use however they choose.

When calculating how much life insurance coverage you need, take a look at your average median household income each year. Figure out how long you want to continue providing for your family after you pass away and multiply that number of years by your income. Then, add on any extras that you’d like to pay for, like education, a downpayment for your child’s first home, etc. The general rule is to multiply your average Canadian salary by 10.

If you’re looking to protect your annual income, speak to one of our licensed insurance advisors. We can walk you through insurance products that will protect your family now and in the future.

Frequently Asked Questions

Is $50,000 a good salary in Canada?

Overall, $50,000 is about $18,000 below the national median after-tax income. As a stand-alone income, it is less than what the average Canadian spent on the cost of living in 2019.

Which city pays the highest salary in Canada?

Toronto has the highest average income in Canada; however, it is also one of the more expensive provinces to live in.

How much is rent in Canada?

The national average rent is $2,005 per month for a one-bedroom unit, according to a May 2023 report. Vancouver is the most expensive city to rent in Canada at $2787 per month.

The median income in Canada is $68,400 after taxes, with Alberta and Ontario having the highest annual salary average. There is still a gender pay gap in Canada, with women earning 89 cents for every dollar earned by men, and racialized and Indigenous women earning even less. Income inequality also exists by age, with younger Canadians earning less than older Canadians, and those with higher levels of education earning more than those without.