- Insurance companies invest your premiums

- What insurance companies choose to invest in depends on the types of returns they’re looking for and their corporate values

- Some companies go out of their way to only invest in sustainable resources

- Look at an insurance provider's CSR plan to know what the company invests in and what they do to support environmental efforts

- How do insurance companies make money?

- What do Canadian companies invest in?

- How does climate change affect insurance?

- What types of insurance are most likely to be affected by climate change?

- What is an ESG fund?

- How do I pick an insurance company that cares about the environment?

- Which Canadian insurers care about the environment?

- Ready to invest sustainably?

As the Earth’s temperature continues to increase, ocean levels rise, and weather patterns become more erratic, climate change poses a more significant risk to our well-being than ever. Thankfully, there are many ways that we can help combat or reduce the impacts of climate change. One way is by ensuring that you spend your money ethically and support companies that act with the planet in mind. This includes insurance companies.

You might be wondering how an insurance company can be good or bad for the environment. Certainly, they don’t have insurance factories pumping out inordinate amounts of carbon dioxide. But the insurance industry, like every industry, has a carbon footprint and environmental impact. A lot of it comes down to understanding how insurance companies make money and how they invest that money.

How do insurance companies make money?

The first and most obvious way a private insurance firm generates revenue is by selling insurance policies. You pay your premiums in exchange for coverage. The money that isn’t used for payout of policies is the revenue used for operating costs, administration fees, etc.

The second and more profitable way they can make money is through investments. Firms take premium payments and reinvest the money in anything from short-term to long-dated portfolios to increase their profits before paying out policy claims. This not only results in dividend payments to their customers from their investments, but also increased interest revenue due to the ability of firms to invest a bigger sum. If you have a whole life insurance plan, you might be familiar with this as some policies offer investment dividends to you as the policyholder.

What do Canadian companies invest in?

Like any investor, a private insurance firm can choose from a wide range of industries and companies to invest in and collect dividends from. As one might expect, they are risk-averse: they want to be sure that their investments will make money.

Previously, companies were heavily invested in Canada Savings Bonds. However, since the termination of the program, companies have had to find other investments. These investments have covered a broad range, including other bonds, banks, companies, and mortgages. But now, Canadian insurance companies have also adjusted their business strategies to allocate greater percentages of their portfolio to sustainable investments.

How does climate change affect insurance?

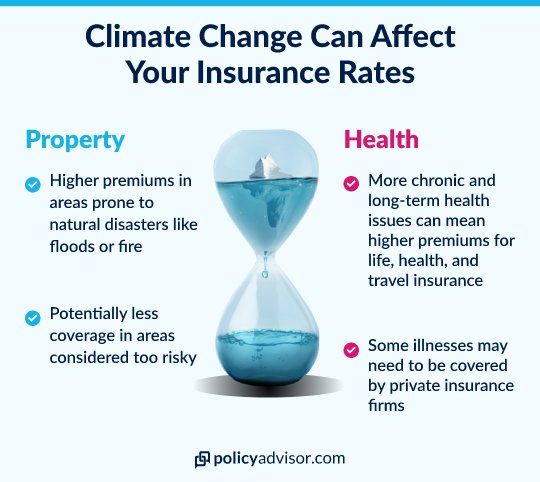

Climate change has and will continue to affect who and what is insured. It influences private insurance options and availability. With the environmental issues caused by climate change comes a new set of liabilities and contingencies to consider when calculating risk, which is what insurance companies do best.

Policies have been and will continue to be adapted and reassessed as we learn more about the implications of climate change. It’s expected that there will be coverage loss, more expensive premiums, changes in underwriting services, and a shift in investments and assets.

Climate change also affects how insurance firms invest. It’s in their best interest to invest in companies that care about the environment. The worse the effects of climate change are, the more expensive the payouts will be to repair damages. As a business, an insurance company wants to be spending as little as possible to increase revenue.

What types of insurance are most likely to be affected by climate change?

- Property (homes and vehicles)

Those who live in areas that are at greater risk for fire, flood, pollution, or other environmental damage can expect to see an increase in their insurance premium. If an insurance company determines that a location is too risky, there could even be a complete loss of types of coverage, such as wildfire or flooding.

- Health

It’s expected that with environmental issues will come a wide range of health problems. There could be more chronic and long-term conditions spurred by climate change that will need to be dealt with by private insurance firms. For instance, years of breathing in smoky air from wildfires could cause chronic lung conditions that would need to be taken into account during the underwriting process for things such as private health coverage, life insurance, critical illness insurance, and disability insurance.

What is an ESG fund?

ESG stands for Environmental, Social, and Governance. These factors help to determine the impact of a company and how it manages and mitigates environmental, social, and governance risks and opportunities. ESG criteria is used by investors and fund managers to determine which investments align with their personal or corporate standards.

An ESG fund is a pool of investments that is selected and managed through ESG investing. The bonds and stocks in this kind of investment pool meet the environmental, social, and governance standards set up by an investor or another third-party evaluator. When looking for investments that are better for the environment, finding an ESG fund is a great place to start.

How do I pick an insurance company that cares about the environment?

There are two things to consider when determining whether an insurance company cares about the environment.

First, get a feel for their everyday business practices:

- Do they promote sustainable practices and company culture?

- Are you able to get a good sense of their values and do they align with yours?

- Do they offer simple solutions like paperless policies to reduce waste, or use energy-efficient light bulbs in their offices?

- Do they support energy efficiency and climate change mitigation?

- Do they seem to be “greenwashing” or using vague buzzwords like “certified green,” “eco-friendly” or “bio-safe” only to appear more sustainable?

Second, and more importantly, do they invest responsibility? Choosing an insurance company that invests in ESG funds means that, by proxy, you are also investing in ESG funds.

While it’s unlikely that you’re going to spend time combing through a company’s portfolio, there are other clues that can indicate responsible investments:

- Do they have policies geared toward climate change and renewable resources?

- Have they set climate change targets like achieving carbon neutrality, or do they project to do so in the near future?

- Are their efforts to mitigate climate change public?

- Does their website have information outlining their environmental strategy or sustainability practices, goals, and achievements?

Which Canadian insurers care about the environment?

Let’s take a look at five of the biggest insurance providers in Canada and see how their sustainability practices and promises stack up.

Manulife Financial Corporation

Manulife outlines their sustainable investing approach by saying they “believe sustainable investing creates long-term value for our stakeholders while helping realize a sustainable trajectory for the global economy.”

Within their reports, they claim to integrate ESG analysis in all their investments and operations. In their 2020 sustainability report, Manulife says they have achieved net-zero carbon emissions in their day-to-day operations. They also say they aim to achieve net-zero carbon emissions for their investment portfolio by 2050. Currently, their green-investment portfolio is worth close to $40 billion.

Read our full review of Manulife term life insurance.

Canada Life

Canada Life says that they “strive to meet responsibilities to minimize environmental impact.”

On their website, they share their ESG key performance indicators (KPIs) for 2020, which disclose their greenhouse gas emissions (GHG) for 2016-2020 as well as water usage and energy consumed. Canada Life also aims to achieve net-zero carbon emissions by 2050 for both investments and operations. However, this means they’ve yet to achieve net-zero for operations as of yet.

Read our full review of Canada Life’s term life insurance.

Sun Life Financial

Sun Life Financial says that “sustainability is essential to our long-term business success in Canada and around the world,” and “being ‘sustainability-driven’ is a key part of Sun Life’s client impact strategy.”

On their website, they share their ESG performance tables, which outline sustainable investment breakdowns for 2019-2021. At present, they claim to have $65.2 billion worth of assets invested in sustainable business and that they have committed to investing a further $20 billion in the next five years. Like Canada Life and Manulife, Sun Life also has a net-zero GHG emission goal for 2050. By 2030, they aim to reduce GHG emissions by 50%.

Read our full review of Sun Life Financial’s term life insurance.

Desjardins Group

Desjardins Group says that they have “always been an advocate of long-term development that balances the three dimensions of sustainable development: economic, social and environmental.”

Like other Canadian insurers, Desjardins Group aims to reduce GHG emissions. They have a goal of net-zero emissions by 2040. Their goal is to emit 41% below their 2019 levels by 2025. In addition, Desjardins Group announced in 2020 that they have begun to and will continue to move away from the coal energy sector.

Read our full review of Desjardin’s term life insurance.

The Co-operators

The Co-operators’ stance on sustainability is that through their “products and services, investments and advocacy, we’re committed to building sustainable, resilient communities — and to protecting the financial security and peace of mind of current and future generations.”

Last year, they announced their goal to achieve net-zero GHG emissions by 2040 for their operations and by 2050 for their investments. The Co-operators also say they have designed their long-term goals using the United Nations Sustainable Development Goals (SDG). They claim that 98% of their investments have been invested according to impact or sustainable investing criteria.

Ready to invest sustainably?

To choose an insurance company that aligns with your values, it’s key to figure out what your values are and what you want from an insurance company and your investments. Once you’ve determined what you care about, it will be a lot easier to find the companies that will work best for you.

Finished researching or looking to get a second opinion on an insurance company that lines up with your values? Book a call with one of our expert advisors today to learn more.

Insurance companies use your insurance premiums and invest the money into many types of portfolios. Most money goes into relatively stable stocks and bonds to provide a general guaranteed rate of return for its policyholders. Some insurance companies place specific importance on investing in sustainable resources and green energy.