- Travel insurance coverage for pregnancy varies depending on the insurance policy and circumstances

- You can be covered for medical emergencies or trip cancellation/interruption due to pregnancy

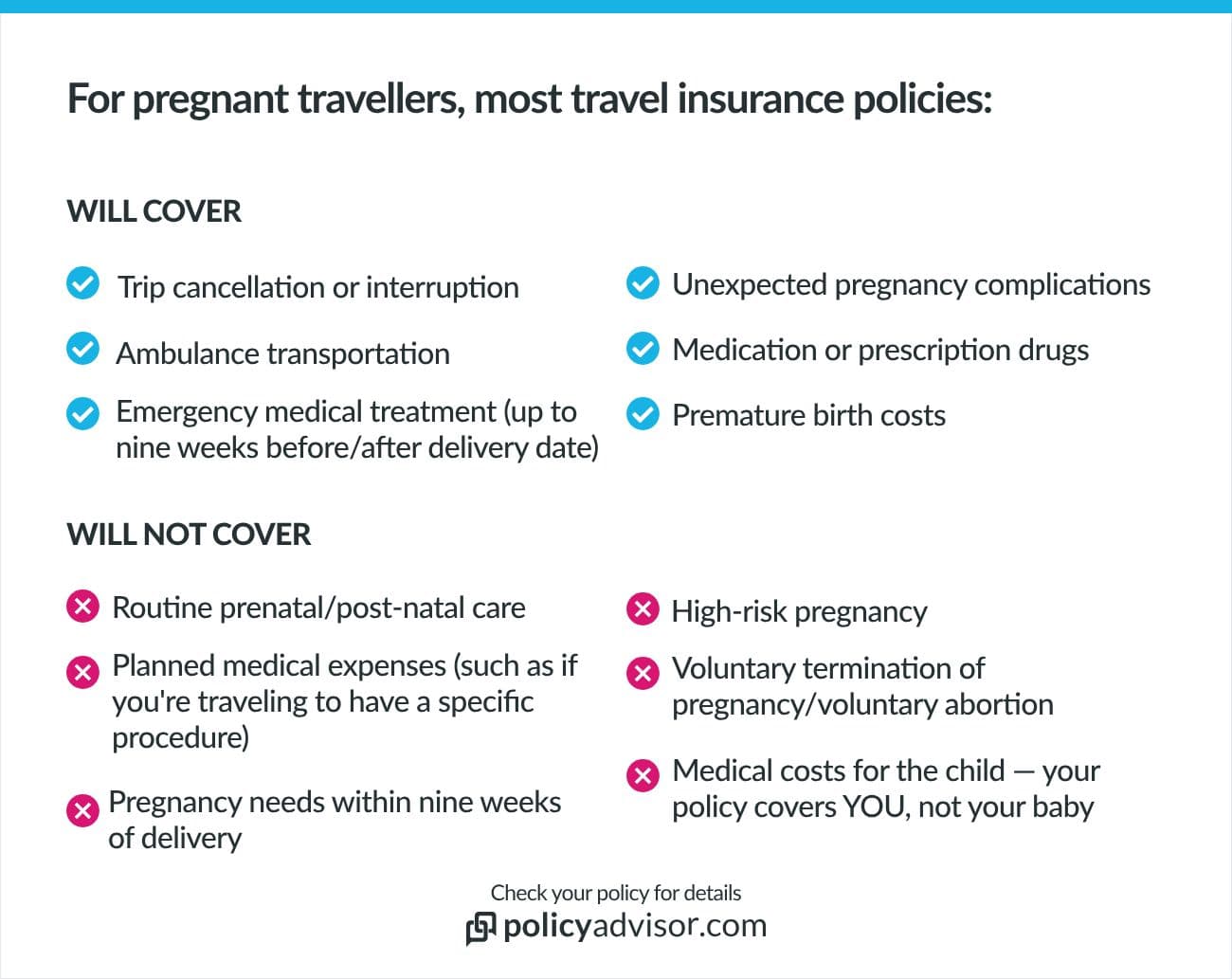

- Most insurance companies do not cover medical costs related to pregnancy within nine weeks before or after the expected delivery date

Does travel insurance cover pregnancy?

Yes, travel insurance may cover pregnancy-related medical expenses depending on your specific circumstances and policy.

Most Canadian insurance companies will not cover pregnancy-related medical expenses within nine weeks before or after the expected delivery date. This means if you’re in the late stages of pregnancy or shortly after giving birth, coverage for related complications is typically excluded.

However, if you plan your trip for a time more than nine weeks before your expected delivery date, and you were not pregnant when you booked your travel, most travel insurance policies will cover you for medical emergencies during your trip.

Additionally, most policies do not cover routine pregnancy check-ups or cancellations purely due to pregnancy unless it’s due to an unforeseen medical emergency.

What is travel insurance?

Travel insurance provides coverage for medical expenses if you become sick or injured during your trip, and can also cover expenses that occur if your trip is cancelled or interrupted due to unforeseen events.

What does travel insurance cover?

- Travel medical and dental care

- Ambulance transportation and repatriation

- Stable pre-existing health conditions

- Travel accidents

- Prescription drugs

- Trip cancellation

- Trip interruption

- Baggage lost/stolen items

Do you need travel insurance if you’re pregnant?

Yes, it’s highly advisable to have travel insurance if you’re pregnant. Travelling while expecting can come with unexpected challenges, and having insurance provides peace of mind.

For comprehensive coverage, you should consider policies that include trip cancellation, medical expenses, and emergency medical evacuation, as these will ensure you’re protected against unforeseen complications.

Eligibility criteria for pregnancy travel insurance

How many weeks pregnant can you get travel insurance?

Most travel insurance providers in Canada offer coverage for pregnant travellers until nine weeks before their due date, usually around the 28th to 32nd week of pregnancy. Therefore, if you plan to travel, it’s best to do so before reaching this stage to secure appropriate travel insurance coverage.

Is pregnancy considered a pre-existing condition?

A normal pregnancy is considered pre-existing for travel insurance if the insured person was pregnant before they bought the policy, or if they became pregnant before their trip starts.

A pre-existing condition is a health issue the traveller had been diagnosed with before they had their insurance policy. It includes health issues like cancer, diabetes, mental health conditions, etc.

Pregnancy is not considered pre-existing if the traveller becomes pregnant after the date their policy starts, which is usually the first day of their trip. For instance, if you’re halfway through your vacation and suddenly find out you’re pregnant, that will not be considered pre-existing and you could be covered for some unexpected healthcare costs if needed.

For normal pregnancies that are pre-existing, no routine care will be covered. You will not be covered for any emergency medical care within nine weeks before or nine weeks after your delivery date.

High-risk pregnancies are also considered pre-existing health conditions, and will not be covered at all.

Does travel insurance cover labour or pregnancy-related issues?

Travel insurance can sometimes cover labour or pregnancy-related issues, but it depends on when the travel was booked, how close is your due date, the date you purchased your travel insurance policy, the type of coverage you’ve chosen, and whether the pregnant person is a Canadian resident travelling abroad or a visitor to Canada.

Can you cancel your trip due to pregnancy?

Yes, you may be eligible to cancel your trip due to pregnancy and receive reimbursement for non-refundable expenses. However, this depends on the following conditions:

- You have trip cancellation coverage or cancel-for-any-reason insurance

- The pregnant individual is:

- You

- Your spouse

- A travel companion

- The spouse or family member of a travel companion

- The pregnancy occurs after the trip is booked

- The pregnancy begins after the insurance policy has been purchased

- The delivery date falls within nine weeks of the scheduled trip

- A doctor advises against travel for the pregnant individual

If these conditions are met, your travel insurance policy can help recover costs associated with flights, accommodation, and other non-refundable expenses. Depending on the policy, it may cover some or all of these costs that would otherwise be lost.

However, in the case of late-term pregnancy, most policies do not cover costs related to routine pregnancy, such as if a doctor advises against travel during the 8th or 9th month as a precaution.

Can you end your trip early because of a pregnancy?

Trip interruption coverage may kick in if you’re already on your trip but want to end it early and go home because of a pregnancy. But it depends on your specific situation and your insurance provider’s rules.

Let’s say you’re on vacation when you realize you’re pregnant, so you want to go home immediately. Your travel insurance may not cover this if the pregnancy is not yet formally diagnosed or if it’s considered normal. And unless you’re travelling for months, you likely won’t be that heavily impacted.

On the other hand, if your babymoon to the Caribbean goes south and you start experiencing pregnancy complications, travel insurance could help cover both emergency medical costs and trip interruption costs. It can cover the costs of returning home early, as well as any unused portions of your trip.

Which Canadian insurance providers should pregnant travellers consider?

If you’re looking for insurance with pregnancy coverage, you can consider the best Canadian travel insurance companies such as GMS, Destination Canada, Tugo, Allianz Global Assistance, Manulife, etc.

You can compare the best travel insurance quotes from these providers and others right here at PolicyAdvisor!

Frequently asked questions

Will travel insurance cover if you deliver a baby in Canada?

No, if you are a visitor you should not come to Canada to deliver your baby. Healthcare costs will not be covered and your travel insurance will not cover your medical expenses or any expenses incurred by your newborn baby.

The same applies to Canadian citizens and residents who deliver babies abroad. Travel insurance does not cover normal deliveries.

How many months pregnant can you travel?

In general, you can travel up to 36 weeks of pregnancy. This is whether you’re travelling by airplane, by boat, or by car. However, you must bear in mind that:

- Not all travel insurance providers will cover you that close to your expected due date

- Some airlines may not allow you to travel that close to your expected due date

- Your doctor may advise you to hold off on travel

It can be tempting to just hop on the next plane out of here if you’re far out from your due date, but you should consider factors like this before making a decision.

What are the flying restrictions for pregnant women?

Most airlines allow pregnant women to fly up to 36 weeks for single pregnancies and up to 32 weeks for multiples, provided there are no medical complications. After 28 weeks, a medical certificate confirming the due date and fitness to fly may be required. Each airline has its own rules, you need to check with the airline before booking.

Is a newborn covered under insurance?

Many travel insurance policies for infants only begin covering your baby 90 days after birth, leaving a gap that may be crucial in case of hospitalization needs. To ensure safety, opt for a travel insurance policy that allows adding your baby to the cover immediately after birth, providing comprehensive coverage for any medical emergencies during your trip.

Do I need to tell the airline I’m pregnant?

Yes, it’s recommended to inform the airline if you’re pregnant, especially if you’re in the later stages of pregnancy. Some airlines have specific policies regarding air travel during pregnancy, particularly after 28 weeks, and may require a medical certificate from a doctor confirming you’re fit to fly.

Does pregnancy travel insurance cover multiple pregnancies or high-risk pregnancies?

Pregnancy travel insurance typically covers pregnancy-related complications, but coverage for multiple pregnancies (e.g., twins) or high-risk pregnancies may vary depending on the provider and policy.

Many standard policies exclude coverage for pregnancies beyond a certain week (usually 32-36 weeks), and high-risk pregnancies might require specialized coverage. So, it is best to check policy terms and see what is covered and what is not.

When should you avoid travelling during pregnancy?

You should avoid travelling during pregnancy if you have a high-risk pregnancy, such as a history of complications or multiple pregnancies. It’s also advisable to avoid travel if your healthcare provider advises against it, if you’re experiencing severe symptoms like high blood pressure, or if your destination has limited access to proper medical care.

With travel insurance, pregnant travellers can get their medical expenses covered if they have a health emergency during their trip. Sometimes they can also get trip cancellation insurance if they can’t go on their trip due to pregnancy. Coverage depends on when the traveller became pregnant and how far away their due date is in relation to their trip dates.