- Snowbird travel insurance covers medical emergencies or other unexpected travel costs for Canadian seniors who spend months away from home

- Snowbirds have more reasons than others to make sure they're protected when they travel to warmer climates during the winter

- Some companies have special snowbird travel insurance packages, but many others offer standard travel insurance policies that can work for snowbirds' needs

Every year, thousands of Canadians say goodbye to the Great White North as they embark on long trips abroad to escape the cold winter months. But, like many travellers, the topic of insurance may not cross these snowbirds’ minds until they’re on the plane. By then it may be too late.

Travel insurance is great for emergency expenses on shorter trips. But, what do Canadians rely on for peace of mind when they’re spending months abroad? This article will go into detail about how snowbirds can make sure they don’t have to pay a lot of money if they have an emergency while away from home.

What is snowbird travel insurance?

Snowbird travel insurance is a special type of travel insurance just for Canadians who go on long trips away from their home area. These plans mostly offer good deals for seniors because they are the main group of snowbirds.

One of the main differences between regular travel insurance and snowbird travel insurance is how long the plans last. Regular travel insurance covers shorter trips, up to 21 days away from home. But snowbird travel insurance can cover up to 212 days.

When buying a travel insurance plan, snowbirds can choose one of the following:

- Single-Trip Plan: Covers just one trip

- Multi-Trip Plan: Covers more than one trip taken within a year

- Top-Up Plan: Extends coverage if they stay away for longer

What is a snowbird?

A snowbird is a Canadian who travels away from home to spend their winter months somewhere with a warmer climate. Most snowbirds are retired Canadian seniors. Some of the most common places snowbirds travel to include:

- Florida

- California

- Costa Rica

- Mexico

- The Caribbean

Snowbirds usually spend months living in a warmer country during the winter. Or, they may “hop” to a few different places before returning back home to Canada once the weather’s warmer.

Why do snowbirds need travel insurance?

Travel insurance policies can help snowbirds pay for unexpected travel expenses that may come up on their journey to or during their stay in countries with warmer climates. And snowbirds have special considerations to keep in mind:

Does OHIP cover snowbirds?

Yes, the Ontario Health Insurance Plan (OHIP) and other provincial health insurance plans can cover Canadian snowbirds in some cases. But it’s very limited coverage. They will only pay for a very small amount of your medical expenses if you get sick outside of Canada. Or they may not pay for anything at all. And, if you stay outside of Canada longer than the allowed number of months, it will stop covering you.

This is why the Canadian government says that any Canadian going on a trip — including snowbirds — should make sure they get their own travel medical insurance plan for visitors. It’s the best way to avoid having to pay extremely high bills if you need medical care while away from home.

How does snowbird travel insurance work?

With snowbird travel insurance, you pay a fee (premium) to an insurance company and in return, they will help pay for costs that may come up if you have a travel emergency. As with most travel insurance, snowbirds customize their plan to fit their needs. They have to pick:

- Coverage amount (ex: $500,000, $1M – $5M, etc.)

- Coverage period (number of days)

- Deductible options (how much you would have to pay in an emergency before insurance kicks in)

- Type of coverage (ex: medical only, trip interruption/cancellation, or more)

They also have to meet certain requirements to get a travel insurance plan, which we’ll discuss more later in this article.

What does snowbird travel insurance cover?

Snowbird travel insurance usually refers to emergency medical travel plans that help pay for costs if you suddenly have to see a doctor or go to the hospital while you’re away from home.

But it can also cover emergencies that aren’t about your health. Snowbird travel plans can cover things like:

- Trip cancellation

- Trip interruption

- Lost or stolen baggage

- Emergency healthcare (hospitalization fees, ambulance fees, etc.)

- Emergency dental treatment

- Prescription drugs

- Emergency evacuation

- Emergency repatriation of remains

- 24-hour travel assistance services

- Pre-existing medical conditions

- And more

What you’re covered for depends on the type of travel plan you get and who your insurance company is. You should check the policy wording before you buy a plan to make sure that it covers everything you need. Or, you should speak with one of our travel insurance specialists so they can help you get the plan you need.

What does snowbird travel insurance not cover?

In general, travel insurance will not cover:

- Routine checkups

- Planned medical procedures

- Cosmetic surgery

- Planned dental expenses

Insurance companies will list anything they won’t cover in a section called “exceptions” in the policy wording. Be sure to carefully read this section or speak with an insurance advisor to find out what you are and are not covered for.

Do snowbird travel insurance plans cover pre-existing health conditions?

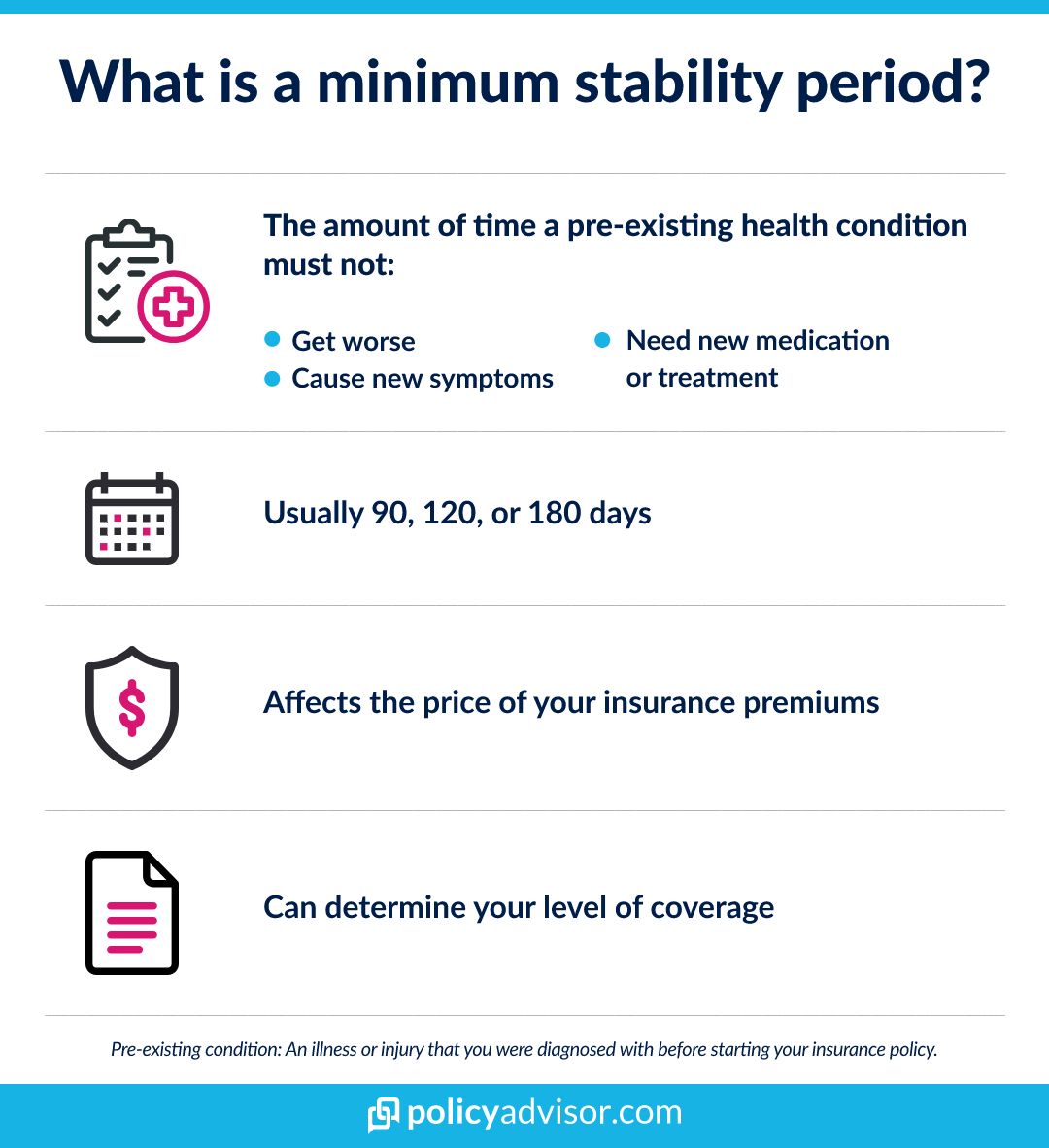

Yes, snowbird travel insurance plans can cover pre-existing health conditions that are stable. This means the health issue must not have:

- Gotten worse

- Caused new symptoms

- Needed a new diagnosis

- Needed new treatment

Insurance companies also look at how long a pre-existing medical issue has been stable. Different companies have different rules about this length of time. They call this a “minimum stability period”. It means that they will only cover a pre-existing condition if it has been stable for at least that amount of time. It’s usually for 90-180 days.

Insurance companies do this because they want to be sure your medical condition won’t cause problems when you’re away for an extended period of time. This is especially for snowbirds, who may be away from home for months at a time.

Some travel insurance companies may not ask you to meet the minimum stability period. Others, like Tugo, may have a special plan for unstable pre-existing conditions coverage. But these types of policies may be rare and will likely be more expensive.

What do Canadians need to get snowbird travel insurance?

To be eligible for snowbird travel insurance plans, travellers usually have to be:

- At least 55 years old

- A Canadian citizen or permanent resident

- Travelling outside of their home province or territory for between 90 to 212 consecutive days

But different types of travel plans can also have different rules. For example, if someone buys annual multi-trip insurance that covers more than one trip they go on in a year, the company may have rules about how many days can be covered for each trip. (Learn more about annual multi-trip travel insurance)

Also, if you’re younger than 55, don’t worry! This is just a general rule for some travel insurance companies. Many other companies have travel insurance options for anyone older than 18 days old! So, you likely have a lot of insurance choices for your travels even if you can’t get some companies’ specific snowbird plans.

You should find out the exact details of any insurance plan you may be interested in. Read the policy wording or speak with one of our expert advisors to find out what the requirements are and make sure you have adequate coverage for your trip!

How much does snowbird travel insurance cost?

Snowbird travel insurance rates depend on:

- Age

- Trip duration

- Destination

- Type of coverage

- Amount of coverage

- Deductible options

- Pre-existing medical conditions

You can expect a snowbird travel insurance policy to cost hundreds. But the cost is well worth the peace of mind of knowing that you’re covered in case an emergency happens. And it’s still far cheaper than the hundreds of thousands in medical costs you could have to pay for emergency health care. The table below shows some costs from top providers.

How much does a snowbird travel insurance policy cost?

| Company | Premium (one-time cost) |

|---|---|

| MSH | $920 |

| Tugo | $990 |

| 21st Century | $1,070 |

| Manulife | $1,070 |

| Destination Canada | $1,120 |

| GMS | $1,310 |

*Quotes based on $5 million in coverage for a 55-year-old traveller and a 180-day, single-trip, emergency medical travel insurance plan, $0 deductible. Stable pre-existing conditions coverage included.

This is just an example, but keep in mind that prices can change based on the factors we mentioned earlier in this article. For instance, choosing higher deductible options would make your premium lower. Or getting coverage for $1 million instead of $5 million would also change the price. You might also be able to get a discount for travel within Canada.

You can easily get a snowbird travel insurance quote on PolicyAdvisor.com! We have a free quoting tool that lets you customize your plan and see travel insurance options from more than 30 of Canada’s best insurance companies in less than a minute. Plus, you can call us or chat with one of our travel insurance specialists online if you want a professional to help you out.

Which Canadian insurance companies offer snowbird travel insurance?

Many Canadian insurance companies sell travel insurance that snowbirds can use when they travel for the winter. Only some companies have travel packages that are just for snowbirds, though. Some of these companies are:

✈️ Blue Cross

A lot of Canadians recognize Blue Cross. They’re known for their travel insurance plans, and they offer really good rates to seniors. Blue Cross’ snowbird plans cover up to $5 million in emergency medical expenses. And they cover stable pre-existing conditions.

✈️ Desjardins

Desjardins is another insurance company that a lot of Canadians know about. They’re mostly known for other types of insurance products, but they offer travel insurance too. Their travel insurance plans for Canadian snowbirds cover up to $5 million for medical emergencies for visitors to Canada.

✈️ Group Medical Services (GMS)

GMS may not be as well-known, but they’re a good travel insurance company. They can also give Canadian snowbirds up to $5 million for emergency healthcare coverage. GMS’ snowbird travel insurance plans cover stable pre-existing health conditions. And they let you extend your plan day-by-day if you need additional travel insurance coverage.

✈️ Medipac

Medipac is another Canadian insurance provider that covers stable pre-existing conditions and can cover up to $5 million for urgent health care for snowbirds.

Where to find the best snowbird travel insurance?

Canadian snowbirds can find the best travel insurance policy for their needs at PolicyAdvisor.com! The best snowbird travel insurance policy is the one that meets your specific needs and budget. And you can easily shop around for the perfect one on our website.

There are a lot of different factors to consider when choosing a plan, so it’s important to do your research and compare or speak with one of our expert advisors who can help find the plan that works best for you.

Can snowbirds get travel insurance through their credit cards?

Yes, Canadian snowbirds can get some form of travel insurance coverage through their credit cards. Many travel credit cards now come with “perks” like travel insurance. But, we strongly advise Canadian snowbirds not to rely on this type of coverage.

Credit card travel coverage usually comes with a lot of rules about what’s not covered. Many of them also only cover you for a very short period of time, so they’re not a great choice for snowbirds who travel away from home for months. They can also have rules like only covering one person, or not covering anyone who’s older than age 65.

If any traveller has credit card travel insurance, they should use it but still get their own travel plan too. This will make sure they actually get the coverage they need. And this is especially important for snowbirds, since they travel so far away for so long, and since they may need something to cover health issues they already have.

Can snowbirds get travel insurance after leaving Canada?

Yes, it is possible to get travel insurance after you’ve already left Canada — but here’s why waiting until the last minute is not a good idea:

It’s always a much better idea to get your travel insurance before your trip starts and long before you’re even at the airport. A lot of snowbirds arrange their travel insurance right when snowbird season starts and they decide which dates they’re going to leave and come back.

When is it too late to buy travel insurance?

Generally speaking, it’s too late to buy travel insurance if you’re already abroad and an emergency is happening. So, you absolutely do not want to get to that point! Speak with one of our advisors to get a travel insurance quote and make arrangements ahead of time.

Do travel advisories affect snowbird insurance coverage?

Yes, travel advisories affect whether snowbird travel insurance will cover you or not. This is the same for any travel insurance plan. If there is a travel advisory against your destination of choice but you still go there, your insurance company won’t cover you.

Travel advisories are just one of the cases where travel insurance won’t cover you — these are called “exceptions”. There are other exceptions too. For instance, if you go on a trip even when your doctor has told you not to travel. In this case, the travel insurance company again won’t cover you. Check your policy to find out what all of the exceptions for your snowbird travel plan are.

Is COVID-19 covered under snowbird travel insurance plans?

Yes, most snowbird insurance policies cover emergencies related to COVID-19. When the pandemic just began, there was some confusion about what would be covered and what wouldn’t. But most travel insurance companies quickly adjusted to include it in their plans. That means most travel insurance plans will cover unexpected costs related to COVID-19, like quarantine or medical treatments.

Read more about COVID-19 travel insurance coverage.

How to get professional insurance advice?

If you need help finding the best snowbird travel insurance, or if you’re unsure about something, don’t forget that you have a free resource available in us! The friendly, licensed agents at PolicyAdvisor are here for you if you need support. Click the button below to schedule a call and speak to an advisor when it’s convenient for you!

Snowbird travel insurance is a type of insurance designed for Canadians who go on long trips outside of their home province or territory. This type of policy is usually for older travellers, like seniors, because they are the main group of snowbirds.