- While not mandatory, having medical insurance when visiting Canada is crucial due to the high cost of healthcare services

- Without insurance, visitors to Canada can face significant out-of-pocket expenses for emergencies, doctor visits, hospitalizations, etc

- Select a plan that covers essential medical services, matches the duration of your stay, and provides complete financial protection

- To ensure adequate coverage, avoid common pitfalls such as underestimating coverage needs, overlooking exclusions, and not aligning the policy duration with your trip length

Every year, millions of tourists come to Canada, but only a few realize the importance of buying medical insurance for visitors to Canada. According to studies, Canada saw 18.3 million international tourist arrivals in 2023, marking a sharp increase from 12.8 million the year before. As tourism rebounds, many travelers continue to overlook one critical detail: Canada’s public healthcare system does not cover non-residents.

Without proper coverage, even a minor illness or accident can lead to overwhelming out-of-pocket expenses. That’s why the Government of Canada urges all travelers to secure medical insurance for visitors to Canada. In this blog, we will help you understand whether you should invest in this insurance policy.

What is medical insurance for visitors to Canada?

Medical insurance for visitors to Canada helps tourists, international students, new immigrants, and other temporary residents pay for emergency healthcare services during their stay. Since Canadian provincial health care plans don’t cover non-residents, visitors must buy private visitor insurance to avoid paying high out-of-pocket costs for medical treatment.

- Who should get travel medical insurance for Canada: Anyone visiting Canada, including tourists, people visiting family, business travellers, Super Visa applicants, and temporary workers, should buy medical insurance. Without coverage, even a minor illness or injury could lead to unexpected and expensive medical bills

- How visitor insurance differs from travel insurance: Travel insurance usually protects your trip by covering delays, cancellations, and lost baggage. In contrast, medical insurance focuses specifically on healthcare costs such as doctor visits, hospital stays, emergency medical treatment, and air ambulance services

- Mandatory requirement for some visas: While the Canadian government doesn’t make medical insurance mandatory for all visitors, some visas, like the Super Visa, require you to have a valid visitor insurance

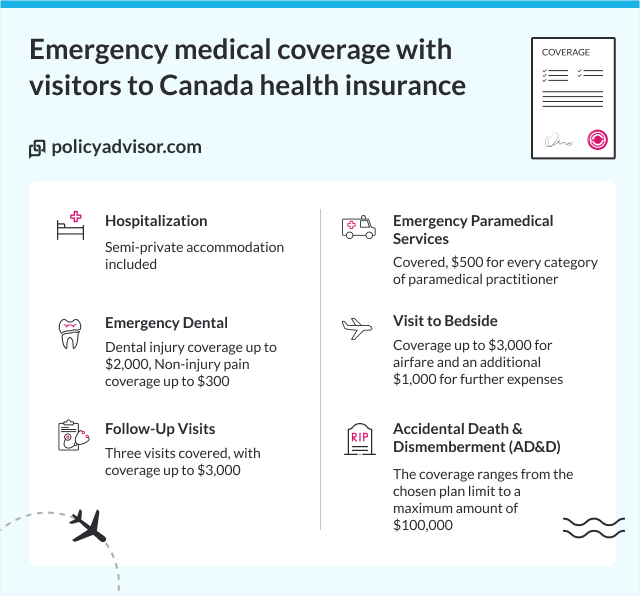

What does emergency medical insurance for visitors cover?

Having emergency medical insurance in Canada provides financial protection from the high cost of healthcare and medical facilities such as doctor consultations, prescription drugs, paramedical services, repatriation and more. Here are a few coverage options that you can avail on purchasing visitors to Canada insurance:

- Physician consultations: Reasonable and customary fees for medical care, whether received in or out of the hospital, from a physician. Unless advised otherwise by the attending physician or the insurance company’s medical team, follow-up visits with the doctor are also covered.

- Prescription drug coverage: Health insurance can cover the cost of prescription medications that may be needed during your stay

- Pathological tests or diagnostic procedures: Visitors to Canada insurance provides comprehensive coverage for various diagnostic procedures including blood work, X-rays, CT scans, MRI, and more

- Paramedical services: Visitors to Canada insurance also covers paramedical services. This includes coverage for services provided by licensed professionals such as physiotherapists, chiropractors, podiatrists, or massage therapists. These services are covered if they are deemed necessary due to a medical emergency, helping visitors recover or manage their health conditions effectively

- Pre-existing condition coverage: Some insurance plans offer coverage for pre-existing conditions, which can be crucial for visitors with ongoing health issues

- Repatriation: Insurance can cover the costs of emergency medical evacuation back to your home country, which can be a significant cost without coverage

- Accidental death and dismemberment (AD&D): Visitors to Canada insurance may also provide a one-time lump sum amount in case of severe accidents that may lead to the death or loss of limbs of the insured, effectively limiting their mobility and working efficiency

- Emergency dental care: Some insurance plans provide coverage for emergency dental treatment or surgery that may have resulted from an accident or sudden injury

- Ambulance transportation: Visitors’ health insurance covers the costs of ambulance services—whether ground or air—needed to transport the visitor to the nearest hospital or medical facility during a medical emergency. This ensures that visitors receive immediate and necessary care without worrying about the high costs associated with emergency transportation

- Hotels, meals, taxis: If a medical emergency requires a visitor to extend their stay in Canada for treatment or recovery, the insurance can cover additional expenses for hotels, meals, and local transportation such as taxis. This coverage can also extend to a travelling companion who needs to stay nearby

- Childcare: If a visitor is hospitalized and unable to care for their dependent child, the visitor to Canada insurance may cover temporary childcare expenses. This ensures the child is safe and looked after while the insured individual receives necessary medical treatment, providing peace of mind during a stressful time

Can I get medical insurance for parents visiting Canada?

Yes, you can get medical insurance for parents visiting Canada. Visitors’ insurance options, including Super Visa insurance, are specifically designed to cover costly out-of-pocket expenses during your family members’ stay in Canada.

Many insurance companies offer visitor insurance plans specifically designed for non-resident parents, covering medical emergencies, hospitalization, physician visits, and other healthcare expenses that might arise during their stay.

When selecting a plan, consider factors like your parents’ age, health conditions, the duration of their stay, and the level of coverage needed. It’s also important to ensure the plan meets the requirements if they are applying for a Super Visa, which mandates a minimum level of medical insurance.

Can non-Canadian citizens get free healthcare?

No, non-Canadian citizens cannot get free healthcare in Canada. The public healthcare system covers Canadian citizens and permanent residents. Non-Canadian citizens, including tourists, temporary residents, and international students, are not eligible for publicly funded healthcare services and will be required to pay out of pocket for any medical care they receive.

What happens if a tourist gets sick in Canada?

If a tourist gets sick in Canada, they will need to seek medical care at their own expense, as Canada’s public healthcare system does not cover non-residents.

Without medical insurance for visitors, non-residents are responsible for paying out-of-pocket for doctor visits, hospital stays, and any necessary treatments, which can be quite expensive.

Can I go to the emergency room (ER) in Canada?

Yes, you can go to the emergency room in Canada as a non-resident. The emergency room (ER) in hospitals is open for everyone in Canada, from residents to visitors. However, unlike Canadian residents, visitors cannot avail government-funded provincial healthcare facilities, making ER visits extremely expensive.

Visitors to Canada can opt for medical insurance to avoid out-of-pocket medical expenses. These plans provide coverage for emergency visits, diagnostic tests, hospital stays, consultation charges, and more.

Can a visitor in Canada get medical insurance?

Yes, visitors in Canada can get medical insurance to protect themselves during their stay. Since Canada’s public healthcare system doesn’t cover tourists or temporary residents, buying health insurance for visitors in Canada is both practical and highly recommended. Without it, even a simple medical emergency could lead to thousands of dollars in out-of-pocket expenses.

Many trusted Canadian insurance providers like Manulife, Blue Cross, GMS, 21st Century, etc, offer travel medical insurance plans suited to the needs of visitors. These plans typically cover emergency medical treatment, hospital stays, ambulance services, and prescription medications.

Some visitor health insurance providers also include coverage for pre-existing conditions, provided your medical condition has been stable for at least 90-180 days.

How much does private medical care cost for visitors in Canada?

A doctor’s consultation in Canada can cost $300 or more. Similarly, a visit to the ER can range from $500 to $1,000 or more, depending on the tests and treatments needed.

Hospital stays can cost significantly more, ranging from $3,000 to $5,000 per day or higher, depending on the level of care, length of stay, and specific medical services provided.

Overall, Canadian healthcare can be quite expensive for non-residents, especially if they do not have health insurance for visitors to Canada.

Emergency medical services costs for non-residents in Canada

| Hospital Service | Cost for Non-Residents in Canada |

| Doctor’s appointments | $930 |

| Emergency visit | $930 |

| X-ray (including hospital visit fee) | $49 and up |

| MRI (plus hospital visit fee) | $2,030 |

| CT scan (plus hospital visit fee) | $2,130 |

| High-risk ultrasound (plus hospital visit fee) | $359 |

| Lab tests, each (plus hospital visit fee) | $360 |

| Ambulance charges | $240 |

| Rehabilitation & mobility appliances | $2-$240 |

| Ward room – Regular | $964 |

| Ward – Intensive care | $4,049 |

| Semi-private room | $1,184 |

| Private room | $1,224 |

*Charges as per a popular hospital in Ontario, Canada

How much does medical insurance for visitors cost in Canada?

The cost of medical insurance for visitors to Canada can range between $20 to $110, depending on the individual’s age, gender, and the province they want to visit.

Here’s an illustration that shows the monthly premium cost for visitor medical insurance in Canada:

Cost of medical insurance for visitors to Canada

| Visitors Age |

Premium ($1,000 deductible) |

Premium ($500 deductible) |

Premium ($0 deductible) |

| 25 years | $28/month | $30/month | $34/month |

| 35 years | $35/month | $38/month | $42/month |

| 45 years | $40/month | $46/month | $53/month |

| 55 years | $45/month | $50/month | $55/month |

| 65 years | $60/month | $54/month | $63/month |

| 75 years | $95/month | $98/month | $114/month |

*The above figures are quotes for $100,000 coverage for an emergency medical plan for an individual with regular health

Does visitor insurance cover COVID-19-related medical expenses in Canada?

Most visitor insurance plans in Canada cover COVID-19-related medical expenses as part of their emergency medical coverage. These plans protect you financially by covering a range of healthcare services you may need if you contract COVID-19 during your visit. Typically, travel insurers cover the following:

- Hospital stays, if COVID-19 symptoms require admission and treatment

- Doctor consultations and visits for diagnosis and ongoing care

- COVID-19 diagnostic tests, including PCR and rapid antigen tests, to confirm infection

- Prescription medications that can help manage symptoms or related health issues

- Ambulance services if you require emergency transportation to a medical facility

- Emergency medical evacuation or repatriation, should your condition demand specialized treatment unavailable locally, or if you need to return home

Some plans may exclude visitor insurance coverage if you travel from high-risk areas or if symptoms existed before purchasing the insurance. You should always review policy terms and understand any waiting periods or exclusions related to COVID-19 before buying visitor insurance in Canada.

How can I choose the right medical insurance plan for visitors in Canada?

Most insurers offer visitors to Canada insurance at different price points, depending on the trip details and coverage type. You can choose from tiered plans such as basic, enhanced, and comprehensive, depending on your requirements.

Different types of visitor medical insurance plans

| Requirements | Basic plan (Premium amount $50- $90/month) |

Enhanced plan (Premium amount ($180-$350/month) |

Comprehensive plan (Premium amount $500-$680/month) |

| Pre-existing disease coverage | Does not cover pre-existing illnesses | Provides coverage for pre-existing diseases that remained stable for 180 days before the policy purchase | Provides coverage for pre-existing diseases that remained stable for 180 days before the policy purchase |

| Emergency hospitalization | Coverage may go up to $50,000 | Coverage may range between $100,000 and $150,000 | Coverage can go beyond $200,000 |

| Prescription drugs | Coverage up to $500 for 30 days of supply | Coverage up to $1,000 per occurrence for 30 days of supply | Coverage up to $10,000 per occurrence for 30 days of supply |

| Dental plans | Coverage not available | Coverage up to $4000 for dental emergencies | Coverage up to $5500 for dental emergencies |

| Accidental Death & Dismemberment | Not included | Coverage up to $25,000 for death and $12,000 for dismemberment included | Coverage up to $35,000 for death and $20,000 for dismemberment included |

| Reparation | Coverage up to $1,500 | Coverage up to $1,850 | Coverage up to $2,500 |

What are the common mistakes to avoid when getting medical insurance in Canada?

Many individuals make mistakes like underestimating their coverage needs or overlooking policy exclusions that can affect their coverage or even result in claim denials during a medical emergency. Take a look at some of the common mistakes to avoid while purchasing medical insurance for visitors in Canada:

- Underestimating coverage needs: Choosing a plan with insufficient coverage limits may expose you to high out-of-pocket expenses. To be on the safer side, opt for plans with a minimum coverage of $100,000

- Overlooking policy exclusions: Individuals should carefully read through their insurance policies to be aware of any exclusions such as routine check-ups, preventive care, maternity care, etc. mentioned in the policy

- Not considering the trip duration: Selecting a policy that doesn’t match the exact length of your stay can leave you unprotected if your trip extends beyond the coverage period. Make sure your policy has room for coverage extensions

- Ensuring your family is covered: If you’re traveling with family, ensure you get medical insurance for parents visiting Canada or for your children who might be travelling with you

How do I file a visitor medical insurance claim in Canada?

Filing a claim with your Canadian visitor medical insurance can seem overwhelming, but following a clear process helps ensure smooth reimbursement. To file a visitor insurance claim successfully, you must notify the insurer immediately, request and fill out a claim form, submit all necessary documents, and monitor your claim status.

- Notify the insurer immediately after receiving medical treatment. Most insurers have a toll-free claims number available 24/7

- Collect all necessary documents, including the completed claim form, original medical invoices, prescriptions, and proof of payment (such as receipts or bank statements)

- Download or request a claim form directly from the insurance provider’s website or through their customer service team

- Complete the form accurately with all required personal details, policy number, dates of treatment, and service provider information

- Submit the documents via email, postal mail, or online portal within the deadline (typically 30 to 90 days from the date of treatment)

- Follow up with the insurer to confirm they received your claim and to track the processing status

- Respond promptly to any additional requests for medical records or clarifications to avoid delays

- Receive reimbursement if the claim is approved, based on the terms and conditions of your policy

What happens if my visitor insurance expires while I’m still in Canada?

If your medical insurance for visitors to Canada expires while you’re still in the country, you risk being left without coverage for any new medical emergencies or treatments. In such cases, you must pay out-of-pocket for all healthcare expenses, which can be extremely costly.

To avoid this, many providers allow you to extend or renew your visitor travel insurance Canada policy before it expires. If you realize your coverage has lapsed, contact your insurer immediately to explore options. Maintaining continuous travel medical insurance protects you from unexpected medical bills and ensures access to necessary healthcare during your stay in Canada.

What should I do if my visitor medical insurance claim gets denied in Canada?

If you face a visitor insurance claim denial in Canada, carefully review the denial letter to understand why the insurer rejected your claim. Contact your insurance provider promptly to discuss the reason for the denial and ask for any additional documents or information that may be needed.

Collect all relevant supporting documents such as medical reports, receipts, and proof of payment to strengthen your case. If you believe the denial is unjustified, submit a formal appeal with detailed evidence. You can also seek guidance from a licensed insurance advisor (such as our experts at PolicyAdvisor) to help navigate the appeal process.

How to get the best travel medical insurance for visitors in Canada?

Securing the best visitor insurance in Canada starts with understanding your unique needs. Whether you’re travelling for a few weeks or several months, the right policy should match your trip duration, age, and any pre-existing medical conditions. This is where PolicyAdvisor can help you!

At PolicyAdvisor, our licensed insurance experts make the process easy for you. They work with over 30 of Canada’s top insurance providers to help you compare plans and choose the one that fits your situation best.

Whether you’re looking for basic emergency coverage or a comprehensive policy, PolicyAdvisor’s team guides you through every step, with lifetime after-sales support to ensure you’re never on your own. Schedule a call with us today to purchase the best medical insurance for your unique needs.

Frequently asked questions

Can you see a doctor without health insurance in Canada?

Yes, you can see a doctor in Canada without health insurance but it is very expensive!

A simple visit to a walk-in clinic or family doctor can cost anywhere from $100 to $300, and emergency room visits can go up to $1,000. To avoid those hefty bills, consider getting visitor insurance before you arrive.

Can a visitor get medical treatment in Canada?

Yes, non-residents can receive medical treatment in Canada, but it’s not free. Canada’s public health care does not extend its offerings to visitors.

This means tourists, international students, and temporary workers must rely on medical insurance for visitors for any healthcare needs during their stay. Without insurance, treatment can be expensive, and visitors will have to pay out of pocket.

What are some of the best companies for health insurance for visitors to Canada?

Canada has a variety of options when it comes to health insurance for visitors to Canada. Some of the best medical insurance companies that provide affordable rates include Manulife, Desjardins, Tugo, Allianz Global Assistance, and more.

While Canada’s healthcare system is excellent, it only covers Canadian residents, leaving visitors responsible for their medical expenses. Medical Insurance for visitors to Canada provides financial protection against unexpected medical costs, which often can be substantial. Investing in a suitable plan can save you from significant out-of-pocket expenses and offer peace of mind during your trip.

Statista. “Inbound Tourist Arrivals in Canada from 2019 to 2023.” Statista, May 2024.

https://www.statista.com/statistics/1324292/inbound-tourist-arrivals-canada/