- Indian visitors to Canada can get different types of travel insurance to protect their trip

- Canadian travel insurance providers offer more coverage options than Indian providers do

- Travel insurance is only mandatory for Canadian super visa insurance

- Do I need to get travel insurance if I travel to Canada from India?

- Why buy travel insurance from a Canadian company?

- Is travel insurance mandatory for Indian visitors to Canada?

- Will my Indian travel insurance cover Canada?

- Which Canadian providers offer travel insurance from India to Canada?

- How much does travel insurance for Canada cost?

- Where can Indian visitors get the best travel insurance for Canada?

- FAQs

Canada’s population is called a mosaic of cultures because many of the people who live here have heritage abroad. Of the more than 8 million people in Canada, 2 million first came to Canada as immigrants. And one in five of those newcomers are of Indian descent.

Every year, over 300,000 people from India visit Canada. Some are tourists taking a short vacation, and lots of others come to Canada to see their family, study, work, or even live here. It’s possible to get travel insurance from India. But it’s a better idea to buy from a Canadian company. You can get more plan options, coverage for health conditions, and more.

In this article, we’ll show you how Canadian travel insurance offers more bang for your buck.

Do I need to get travel insurance if I travel to Canada from India?

Yes, it is highly recommended that you get travel insurance if you are planning a trip from India to Canada. Travel insurance can help you avoid paying extremely high costs if something unexpected happens. No matter what your reason is for travelling to Canada, this protection can help make sure your trip is stress-free from start to finish. And Canadian travel insurance providers will give you the best options.

What is travel insurance?

Travel insurance is like a safety shield that protects you during your trip from India to Canada. It’s a special kind of insurance that helps make sure you’re taken care of if something goes wrong while you’re travelling. It can help pay for things like sudden sickness, serious injuries or accidents, luggage loss, cancelled flights, and other unexpected events.

Types of travel insurance

There are many different types of travel insurance plans to choose from, and you can get coverage in multiple ways. The most common types of travel insurance that Indian visitors to Canada buy are:

- Emergency medical insurance

- Super visa insurance

Apart from these options, there are also non-medical plans that cover unexpected travel expenses due to things like trip cancellation, trip interruption or delay, baggage loss, and more. You can also get a family travel insurance plan that includes your close family members.

Why do you need travel insurance from India to Canada?

When travelling from India to Canada, travel insurance is an essential safeguard that provides comprehensive protection against unforeseen situations such as medical emergencies, trip cancellations, flight delays, lost luggage, and more.

- Medical emergencies: Healthcare in Canada can be expensive, especially for international travellers. Travel insurance covers unexpected medical emergencies, including hospital stays, surgeries, and doctor visits, ensuring you don’t face financial strain due to illness or injury

- Flight cancellations and delays: Travel insurance helps recover costs if your flight is delayed or canceled. It can cover accommodation, food, and transportation expenses incurred while waiting for your new flight

- Lost or delayed luggage: Lost or delayed luggage can cause significant inconvenience. Insurance policies typically provide compensation to replace essential items while you wait for your luggage

- Trip cancellations: Sometimes, unforeseen events force travellers to cancel or cut short their trip. Travel insurance can help recover non-refundable expenses such as hotel bookings and flight tickets

- Accidental coverage: Many travel insurance policies offer coverage for accidental injuries, providing compensation in case of disability or death during the trip

- Coverage for pre-existing conditions: Certain policies offer coverage for pre-existing health conditions, allowing travellers with ongoing medical needs to travel without worry

Can I get travel insurance from a Canadian company?

Yes, you can get Canadian travel insurance even if you’re not Canadian or if you haven’t arrived in the country yet. In fact, this is often your best option! Canadian companies have travel insurance policies for foreigners, and you can take advantage of this.

Why buy travel insurance from a Canadian company?

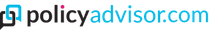

India visitors to Canada should buy their travel insurance from a Canadian provider for several reasons:

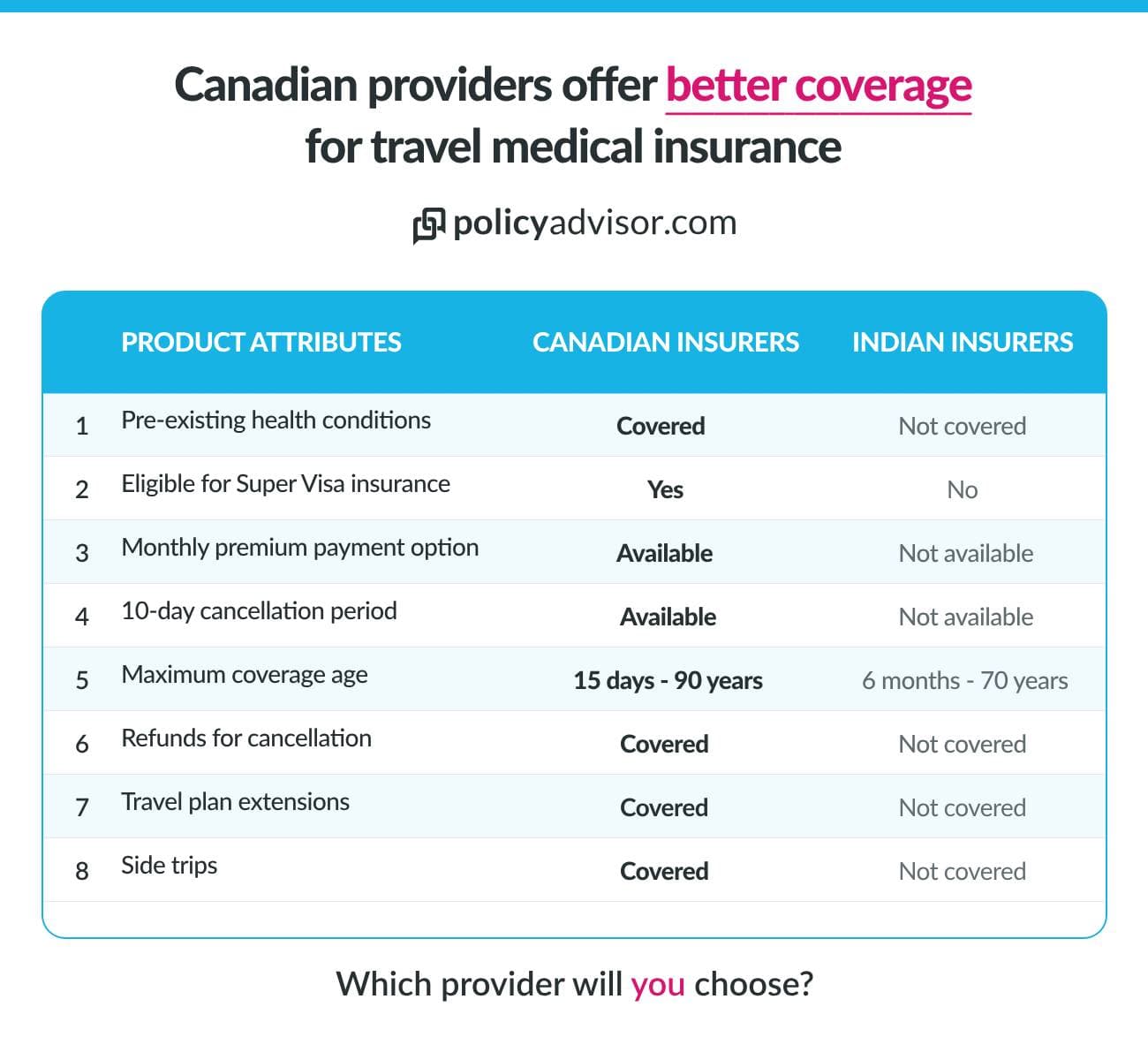

More complete coverage

When it comes to health coverage for travel, insurance plans from Canada can often include more types of health problems than plans from India. Unlike travel insurance from Indian providers, Canadian travel insurance also:

- Covers stable health conditions you may already have

- Lets you keep your policy longer if you stay in Canada for a longer time

- Have a 10-day refund period

PolicyAdvisor.com looked at popular travel insurance plans from leading Indian insurance providers and compared that with what Canadian companies offer. Check out the charts below to see how they compare.

More deductible options

A travel insurance deductible is the part of the medical bill you pay upfront before the insurance kicks in. The deductible you choose affects the cost of your travel insurance plan. Canadian providers give you the option to set a $0 deductible, so you won’t pay anything upfront and the company covers the entire medical bill. Indian travel insurance providers do not provide this same option.

Covers a wider age range

Travellers as young as 15 days old and up to 90 years old can get travel insurance through a Canadian provider. This is a wider range of coverage than Indian providers, which generally only provide insurance plans for those between six months and 70 years old.

Better security

When you get travel insurance from a Canadian provider, you know you’re getting coverage you can trust. Canadian advisors live here, so they can better advise on what kind of coverage you need, what coverage amount would be best, and which deductible options are most feasible.

Necessity

You have to buy super visa insurance from a company in Canada. If you buy this kind of insurance from an Indian company, it will not be valid and you may not be allowed to enter the country.

If you’re planning to travel to Canada from India for any reason, you should speak with our licensed travel specialists. We can help you find the best options for travel insurance coverage based on your needs. Our team would be happy to help guide you to making an informed decision about policies, and also help you find the most affordable travel health insurance plan for your trip!

Is travel insurance mandatory for Indian visitors to Canada?

No, you usually don’t have to get travel insurance when you go to Canada from India. Most times, Canadian immigration will let you enter the country even if you don’t have travel insurance.

However, we strongly recommend that you get some type of travel insurance for your trip. It can help you avoid unexpected expenses and enjoy a stress-free stay in Canada.

There’s also a special rule for people with a Super Visa. If you have this kind of visa, you MUST get travel medical insurance for at least one year. This insurance is important because it helps pay for emergency medical care while you’re in Canada.

Why buy travel insurance?

You should get travel insurance for your trip to Canada to have peace of mind for your journey and to avoid extreme costs if something unexpected happens.

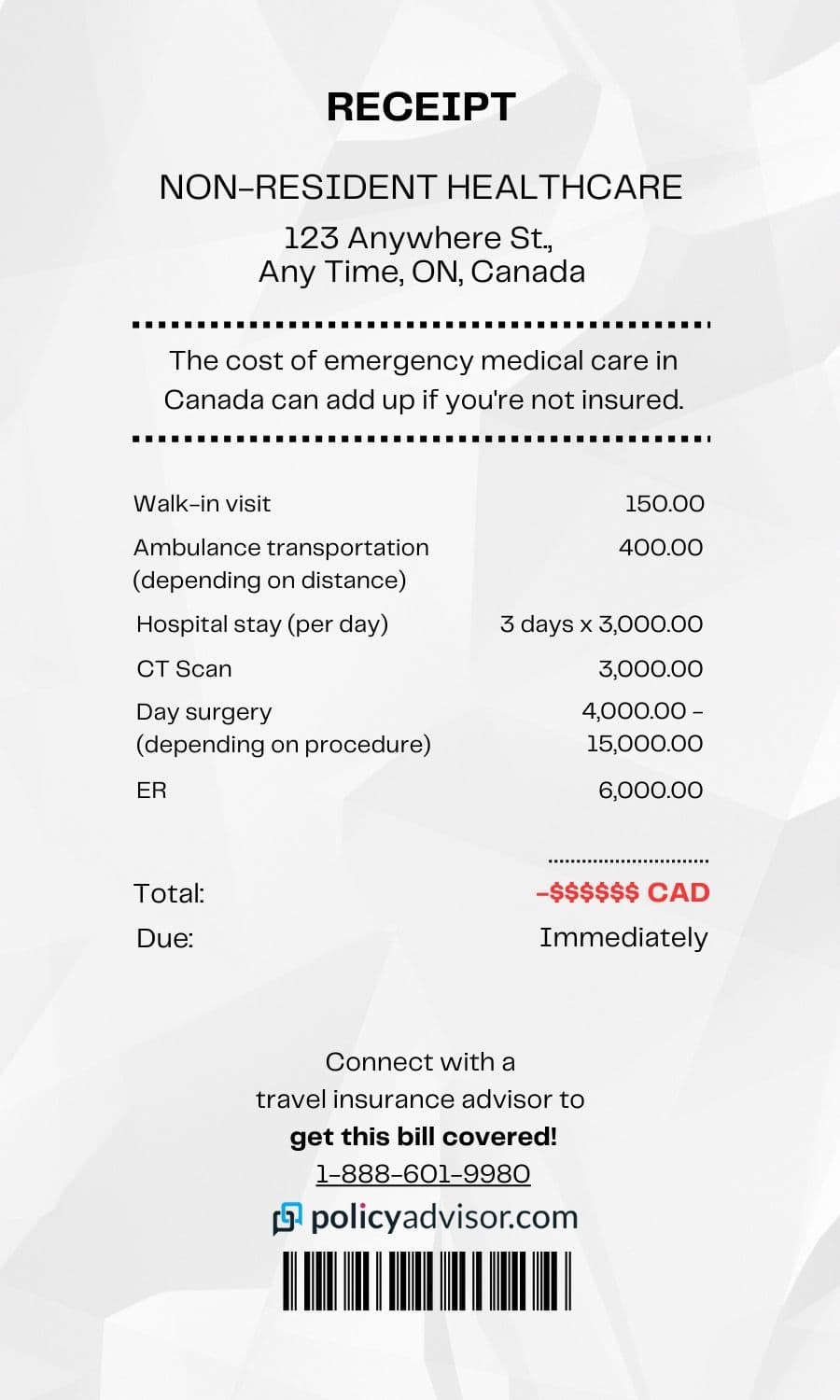

How much could emergency healthcare cost you in Canada?

Thankfully, travel insurance is here to rescue you from this dilemma! Travel insurance companies can help cover these kinds of costs, so you can enjoy the Great White North without worrying about money troubles.

What kind of travel insurance do I need to visit Canada?

The kind of travel insurance you need to come to Canada from India depends on the reason for your trip. Take a look at some of the scenarios below for an idea of what kind of travel insurance you should get if you’re coming to Canada.

Will my Indian travel insurance cover Canada?

If you got travel insurance from an Indian company, it might work for Canada. But that depends on the provider. And, even if it does cover Canada, it might not protect you completely.

Travel insurance from an Indian provider also won’t work at all for super visa insurance. You HAVE to buy super visa insurance from an authorized Canadian insurance company that’s allowed to offer it. Policies from India don’t count for this type of travel.

Which Indian companies offer travel insurance for Canada?

As a visitor from India, you may see travel packages from the following companies:

1. TATA AIG

Product: Travel Guard

Tata AIG General Insurance Company Limited was founded in 2001 by the Tata Group and the American International Group (AIG). It primarily offers travel insurance, marine insurance, and liability insurance.

2. HDFC ERGO

Product: Easy Travel

HDFC Ergo General Insurance Company was founded in 2002 by HDFC Bank and ERGO International, the primary insurance entity of Munich Re Group. It offers a wide range of insurance products.

3. Royal Sundaram

Product: Travel Secure

Royal Sundaram General Insurance Co. Limited was founded in 2001 and became the first private-sector general insurance company in India to be licensed by the Insurance Regulatory and Development Authority of India (IRDAI).

4. Care Insurance

Product: Explore Canada+

Care Health Insurance was founded in 2012 as a subsidiary of Religare Enterprise. It primarily offers travel insurance, health insurance, and personal accident insurance.

5. Reliance General Insurance

Product: Travel Care

Reliance General Insurance was founded in 2000 and has become a major provider of travel insurance across India.

6. ICICI Lombard General Insurance

Product: Overseas Travel Insurance

ICICI Lombard General Insurance was founded in 2001 and offers a wide range of insurance products.

7. Chola MS

Product: Overseas Travel Protection

Chola MS General Insurance was founded in 2001 by the Murugappa Group and Mitsui Sumitomo Insurance Company Limited, Japan. It offers a wide range of insurance products.

8. Bajaj Allianz

Product: Travel Ace and Travel Elite

Bajaj Allianz was founded in 2000 by Allianz SE and Bajaj Finserv Limited. It offers travel insurance, life insurance, car insurance, and health insurance.

Which Canadian providers offer travel insurance for Indian visitors?

Some of Canada’s best insurance companies provide travel insurance to Indian visitors. This includes Travelance, GMS, Destination Canada, Manulife and more:

- Travelance: Founded in 2013 and specializes in Visitors to Canada Insurance.

- GMS: Founded in 1949 and specializes in Visitors to Canada Insurance and Health Insurance.

- Destination Canada: Founded in 1991 and specializes in Visitors to Canada Insurance.

- Manulife: One of the oldest and most trusted insurance companies in Canada. Founded in 1887 and provides a wide range of insurance products and financial services.

At PolicyAdvisor.com, we work with all of these companies and more to bring you the best options for visitor insurance coverage. Contact us today to explore your best options, or click the button below to easily browse travel insurance quotes in minutes using our free platform.

How much does travel insurance for Canada cost?

The price for your travel insurance policy will depend on things like

- What kind of coverage you get

- How much coverage you get

- How long your trip is

- Other factors

Canadian travel insurance is not expensive. Most plans are affordable and provide a lot of coverage. The chart below gives you a better idea of how much travel insurance would cost for Canada from India, depending on how long.

Cost of travel insurance in Canada

| Age | Cost for 7 days | Cost for 30 days |

|---|---|---|

| 25 | $18 | $59 |

| 35 | $20 | $72 |

| 45 | $20 | $91 |

| 55 | $21 | $91 |

| 65 | $25 | $131 |

| 75 | $45 | $223 |

*A single-trip travel insurance policy with emergency medical coverage, $100,000 in coverage and a $1,000 deductible. The price is in Canadian dollars.

Super visa insurance usually costs more than regular visitor’s insurance for Canada. That’s because the Canadian government has stricter rules for super visa holders. They need more coverage for a longer time, and since super visa holders are usually older, they also need insurance to cover pre-existing medical conditions they already had before. All these things add up and make the cost a little higher.

The cost of travel insurance for Canada from India can be different depending on your situation. Use our free online quoting tool to compare prices and see what works best for you! You can also speak with our travel insurance specialists if you prefer to get expert advice.

Where can I get the best travel insurance for Canada from India?

If you’re planning to travel from India to Canada, you can easily find the best travel insurance for your needs through PolicyAdvisor.com! Shop the best prices and providers online at the click of a button. Or chat with our licensed, friendly advisors who can give you insider guidance. Find the perfect plan that meets your budget with our help today!

Frequently Asked Questions

Do I really need travel insurance to go to Canada?

Technically, you don’t have to have travel insurance when you come to Canada as a visitor, unless you have a super visa. Your visa application form won’t be turned down if you don’t have a travel medical insurance policy.

However, we strongly recommend that you get it. This way, you can enjoy your stay in Canada without stressing about huge medical bills or other surprise costs.

Will my Indian health insurance cover me in Canada?

No, your Indian health insurance policy will not apply to your trip to Canada. Once you leave your home country, you’ll have to pay the bill yourself if a medical emergency happens — unless you have Canadian travel health insurance for visitors to cover you.

Do international students in Canada need to get travel insurance?

International students in Canada don’t have to get travel insurance, but we suggest you consider it. Many students already have insurance from their school or group. However, there might be some things not covered, so it could be a good idea for students to get their own insurance too.

For example, some schools only give health insurance when classes are happening. So, if international students need medical help during breaks like Christmas or summer, they might not be covered.

Can I get travel insurance for Canada after I already left India?

No, you cannot get a new Canadian travel insurance policy after you already left India. Your travel insurance policy has to be bought before your trip starts, so it’s best to make sure you purchase it at least a few days before you leave.

Can I extend my Canadian travel insurance?

Yes, you can extend your travel insurance policy if you need to. Canadian insurance companies give you this option in case you end up staying in Canada longer than you originally planned to. All you have to do is contact your agent or advisor to let them know. Indian insurance companies do not give you this option, but Canadian companies do.

Can I get a refund on Canadian travel insurance?

Yes, there are some circumstances where you can get a refund on your Canadian travel insurance, such as:

- Your trip was cancelled

- Your Canadian visitor visa was denied

- You started a Canadian government health insurance plan

Is there anything that Canadian travel insurance won’t cover?

Yes, there are some things Canadian travel insurance providers will not cover. While they often offer more comprehensive travel insurance solutions, they exclude routine medical care, pregnancy, unstable pre-existing conditions, individuals traveling against the advice of a physician, medical emergencies, or costs that have originated in India.

Remember, if you have any questions about travel insurance for Canada from India, our experts are here to help you explore the best coverage options. Schedule a call to get one-on-one guidance or chat with us online today!

Indian citizens who plan to visit Canada should get travel insurance to protect their trip. It’s not required, but it can help them stay protected against unforeseen expenses and have better peace of mind during their stay. They should also buy from Canadian companies, which have better travel insurance options than Indian providers and can cover pre-existing conditions.

1-888-601-9980

1-888-601-9980