- Monthly visitor insurance in Canada costs between $70–$500 per month in 2025, depending on age, coverage amount, and pre-existing conditions

- Four major providers offer monthly payment plans: Destination Canada: From $70/month, minimum $50,000 coverage, Travelance: From $85/month, $60 setup fee, 21st Century: From $95/month, $50 setup fee, Secure Travel: From $110/month, $120 setup fee

- Monthly plans typically require a minimum coverage period of 90–365 days and a two-month security deposit

Some insurance companies will allow monthly payment options for your visitor health insurance plan. Visitor insurance, also known as visitor to Canada insurance, provides essential medical coverage for those who are not covered by Canada’s provincial healthcare.

Monthly visitor insurance payments can be a game-changer for non-residents, especially students, foreign workers, and returning Canadians. The monthly payment option helps manage budgets better by avoiding significant upfront costs and ensuring coverage during the waiting periods for provincial healthcare or university plans.

This blog will give you insights into how monthly payment plans work, which companies offer it, the factors that influence premiums, and tips for finding the best insurance coverage to suit your needs while staying in Canada.

Monthly visitor insurance plans in Canada – What’s new in 2025

Visitor insurance in Canada has evolved significantly in 2025, with more providers offering flexible monthly payment visitor insurance options.

Some of the key developments include:

- Super Visa insurance monthly installments are now accepted by immigration authorities

- Reduced setup fees for monthly visitor health insurance plans

- Extended grace periods for missed payments on visitor insurance monthly plans

- New budget-friendly options for international students and temporary workers

How can I pay for visitors’ insurance in Canada?

When purchasing visitor insurance in Canada, you have two primary payment options: lump-sum and monthly payment plans.

A lump-sum payment plan, as the name suggests, is when you pay the entire premium at the time of purchasing your visitor insurance policy. A monthly payment plan is a more flexible option where you pay the insurance premium in affordable monthly installments.

Can I pay monthly for medical health insurance in Canada?

Monthly payment plans for visitor medical insurance allow you to spread the cost of the insurance over several months. This option can be more manageable for those on a budget or with a limited cash flow, as it breaks down the total premium into smaller, more affordable installments.

It also provides flexibility for travellers who may not know the exact length of their stay in Canada, allowing them to adjust their coverage period as needed. However, due to the extended payment period, monthly plans might include additional fees or slightly higher premiums.

Can I pay for Super Visa insurance monthly?

Generally, Super Visa insurance requires a lump-sum payment upfront for the entire coverage period, typically one year, to meet the visa requirements. This is because Super Visa insurance must provide a minimum of $100,000 in emergency medical coverage for at least one year.

Recent updates from the Canadian government allow for Super Visa insurance to be paid in monthly installments, although this option is currently limited to certain insurance providers.

The insurance premium must be fully paid by the time the individual arrives in Canada, either through a full annual payment or a deposit for a monthly payment plan.

How much does health insurance for visitors to Canada cost per month?

Visitors to Canada monthly payment plans can cost between $70 to $500, depending on the age and health condition of the applicant. Here is a table with some of the monthly premium costs for individuals aged between 25 and 85 years, with and without pre-existing health conditions:

Cost of medical insurance for visitors to Canada

| Visitor’s age | Premiums with pre-existing condition |

| 25 years | $92.70/mo. |

| 35 years | $100.20/mo. |

| 45 years | $115.50/mo. |

| 55 years | $129.60/mo. |

| 65 years | $168.60/mo. |

| 75 years | $328.80/mo. |

| 85 years | $453.92/mo. |

*Cost of $100k in coverage for a non-resident in Canada for a 30-day period

Benefits of paying monthly for visitors to Canada insurance

Monthly payment plans for visitors to Canada insurance offer flexibility and help manage those who are on a tight budget. Some of the key benefits of monthly payment plans for health insurance for visitors to Canada are:

- No large upfront costs: One of the most significant advantages of opting for a monthly payment plan is avoiding a large upfront payment. This can be especially beneficial for visitors who have already incurred considerable travel expenses or are trying to conserve their savings for other purposes

- Flexibility: Monthly payments provide greater flexibility, especially for visitors who are uncertain about the exact length of their stay in Canada. With a monthly plan, visitors can pay only for the period that they spend in Canada

- Affordability and budget management: Spreading the insurance cost over several months can make the expenses more manageable, especially for those on a tight budget. Paying a smaller amount each month allows visitors to allocate their funds more effectively across other travel expenses, such as accommodation, food, and transportation

2025 Monthly visitor insurance trends in Canada

- Digital-first applications: 85% of monthly plans now offer instant online approval

- AI-powered claims processing: Faster approvals and reduced paperwork for monthly plan holders

- Flexible coverage adjustments: Change coverage amounts mid-policy without penalties

- Enhanced telemedicine: 24/7 virtual doctor consultations are included in most monthly plans

- Climate coverage: New provisions cover extreme weather-related medical needs

- Mental health coverage: Expanded coverage for stress and anxiety-related treatments

Which companies offer monthly payment plans for visitors to Canada insurance?

Travelance, 21st Century, Secure Travel, and Destination are the four Canadian insurance providers that offer monthly payment plans for health insurance for visitors in Canada. Here are the details about each of them:

1. Monthly plans offered by Travelance

Travelance offers multiple payment plans for non-residents in Canada provided they meet these criteria:

- Their trip duration is a minimum of 90 days

- The coverage value is at least $100,000

- Have a valid credit card on file

- The setup fee is $60

The two months’ refundable premium that is collected at the time of the application, is applied only to the last two scheduled payments. If you miss two consecutive months’ payment for your Travelance visitor to Canada insurance premium, your coverage will end.

2. Monthly plans offered by 21st Century

21st Century offers a monthly payment plan for visitor insurance in Canada on fulfilling the following criteria:

- Available for Super Visa, Visitor, and work/student visa types.

- Minimum coverage limits of $100,000

- Coverage period of 365 days or 730 days

- Non-refundable set-up fee: $50

21st Century provides refunds for any unused full months of coverage, but partial months are non-refundable. All refund requests must be approved, and a $25 processing fee applies to each refund.

3. Monthly plans offered by Secure Travel (RIMI)

Secure Travel, previously known as RIMI, also allows users to pay their visitor insurance premiums on a monthly basis. If you have selected the monthly payment option monthly payment amounts will be calculated as 1/12 of the total premium due.

The criteria for Secure Travel’s monthly plan are as follows:

- Minimum coverage limit of $100,000

- Minimum coverage period of 365 days

- Non-refundable setup fee: $120

- Upfront security deposit: 2 months

Once the policy becomes effective, the individuals can pay the remaining 10 months’ premiums monthly.

4. Monthly plans offered by Destination Canada

Destination Canada offers monthly payment plans to non-residents of Canada who:

- Has a minimum coverage of $50,000

- Has a minimum coverage period of 180 days

- Must pay a 10% surcharge

- Must pay an upfront security deposit for 2 months

Once the policy becomes effective, the rest of the premiums can be paid monthly.

Best monthly visitor insurance plans providers Canada: 2025 Comparison

When choosing monthly visitor insurance in Canada for 2025, it’s important to compare costs, setup fees, coverage limits, and unique advantages.

Below is a quick comparison of the best monthly visitor insurance providers in Canada this year.

Best monthly visitor insurance plans’ providers in Canada

Monthly visitor insurance by Canadian province in 2025

Monthly visitor insurance coverage varies by province due to different healthcare systems and regulations:

Ontario Monthly Visitor Insurance

Ontario visitors benefit from the most competitive monthly rates, with plans starting at $70/month. Toronto and Ottawa residents have access to the largest provider network.

British Columbia Monthly Plans

BC visitors can access specialized monthly plans through provincial partnerships, with enhanced coverage for outdoor activities popular in Vancouver and Victoria.

Alberta & Prairie Provinces

Monthly visitor insurance in Alberta offers competitive rates for oil industry workers and temporary residents, with plans starting at $75/month.

Quebec Monthly Visitor Coverage

Quebec’s unique healthcare system requires specialized monthly visitor insurance plans, available through bilingual customer service in French and English.

Atlantic Canada Monthly Options

Maritime provinces offer seasonal monthly plans ideal for temporary workers in the fishing and tourism industries.

| Provider | Monthly premium range | Setup fee | Minimum coverage | Best for | 2025 Advantage |

| Travelance | $85–$450 | $60 (lowest among competitors) | $100,000 | Super Visa holders, long-term visitors | Fastest claim processing in Canada |

| Destination Canada | $70–$395 | 10% surcharge (no fixed fee) | $50,000 | Budget-conscious visitors, students | Most flexible payment terms |

| 21st Century | $95–$450 | $50 | $100,000 | Families, comprehensive coverage seekers | Enhanced pre-existing condition coverage |

| Secure Travel (RIMI) | $110–$455 | $120 (highest but comprehensive) | $100,000 | High-risk visitors, maximum protection | Expanded hospital network coverage |

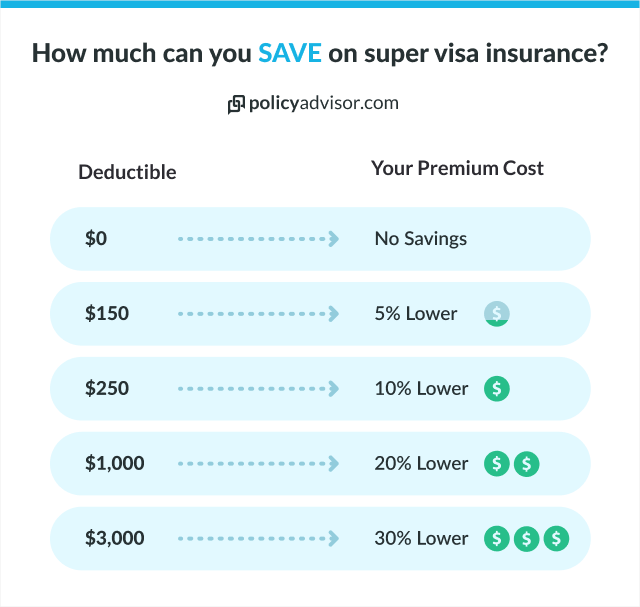

How does the monthly payment option impact the overall cost of the insurance?

Choosing monthly payments can increase the overall cost of insurance due to higher total premiums, administrative fees, and potential interest charges. Monthly plans often come with slightly higher rates as insurers charge for the convenience provided and account for the added risk and cost of managing ongoing payments.

Additionally, missed or late payments might lead to coverage lapses or penalties, which can further add to the total expense if coverage needs to be reinstated.

Comparing the total cost of monthly payments with the cost of paying the premium in a lump sum can help you determine the most economical option.

What are the potential risks of choosing monthly payments for visitors’ health insurance?

While monthly payment plans are a great option for tourists in Canada, it does have some potential drawbacks such as higher overall costs, coverage gaps, and limited availability.

- Higher overall costs: Monthly plans often come with slightly higher overall costs than paying the entire premium upfront. Insurance providers may charge additional fees or offer less favorable rates for the convenience of spreading payments

- Limited availability: Not all insurance providers offer monthly payment options. This can limit your choices and might require additional research to find a provider that meets your needs with this payment structure

- Cancellation policies and fees: If you need to cancel your policy, you may encounter cancellation fees or policies that make it challenging to obtain a refund for unused coverage

What happens when I cancel my monthly plan?

When you cancel your monthly visitor insurance plan, you may be subjected to cancellation fees, partial refunds, and a complete loss of coverage. Find out more:

- Cancellation fees: Some insurance providers may charge a cancellation fee if you end your plan early. This fee can vary depending on the provider and the time remaining on your policy

- Refunds: Depending on the provider’s policy, you might be eligible for a partial refund of unused premiums. However, this refund is usually prorated and may exclude any administrative or cancellation fees

- Loss of coverage: Once you cancel your plan, your coverage will end immediately or on the last day of the paid month. This means you will no longer be protected from any medical emergencies or covered incidents after the cancellation date

How to choose the right monthly payment plan?

Choosing the right monthly visitor insurance plan in Canada ensures you’re protected without overspending. Here’s what to look for:

- Assess the visitor’s age, health status, and length of stay

Choose plans with emergency medical, hospitalization, and prescription coverage - Look for options that cover stable pre-existing conditions

- Schedule a call with an experienced advisor so you can compare insurers for pricing, refund rules, and claims support

- Read the fine print, check deductibles, cancellation terms, and exclusions

What is the application process for monthly payment plans?

Applying for a monthly visitor insurance plan in Canada is straightforward but requires attention to detail. Here are the steps to ensure approval and proper coverage.

- Choose a Canadian-licensed insurance provider offering monthly payment options

- Select the desired coverage amount and duration

- Fill out the online application form with visitor details

- Choose the monthly payment option at checkout

- Review and submit your application

Required documentation

- The visitor’s personal information (passport details, date of birth)

- Travel dates and Canadian address (if available)

- Payment method for recurring billing

- Medical history if applying for coverage with pre-existing conditions

Tips for a smooth application

- Apply at least a week before travel to avoid delays

- Double-check all entered details for accuracy

- Save a copy of the policy and payment confirmation

- Contact the insurer for help if unclear about medical questions or coverage terms

Get the most affordable monthly visitor’s insurance quotes in Canada

Finding the best visitor insurance quotes in Canada starts with understanding your specific needs and thoroughly researching different policies.

For those looking to simplify the search, turning to insurance experts like those at PolicyAdvisor can make the process seamless and easy. PolicyAdvisor offers personalized guidance, comparing a wide range of options to find the best match for your requirements and budget.

Our expert team can help you navigate the fine print, ensuring you understand all policy details and avoid any expensive surprises. Let PolicyAdvisor take the guesswork out of finding the right visitor insurance, so you can focus on enjoying your stay in Canada.

Frequently Asked Questions

Will I get a refund on my monthly payment plan in case of early departure?

Refunds for monthly payment plans for visitor insurance in Canada depend on the terms and conditions of your specific policy. Some insurance providers may offer a partial refund for the unused portion of your coverage if you leave Canada earlier than expected.

However, this refund is often prorated and may be subject to certain conditions, such as providing proof of early departure and submitting a refund request within a specific time frame. Additionally, cancellation fees or administrative charges may reduce the refund amount.

What happens if I miss a monthly payment?

If you miss a monthly payment on your visitor insurance plan, your coverage may be at risk. Most providers offer a grace period to make the payment without losing coverage. Your policy could lapse if payment is not made within this period, leaving you unprotected.

Can I switch from a monthly payment plan to a lump-sum payment?

Yes, many insurance providers allow you to switch from a monthly payment plan to a lump-sum payment. However, this may depend on the terms of your policy and the provider’s rules.

You may need to pay the remaining balance in full, and some providers might charge a fee for changing payment plans. It’s best to contact your insurer directly to discuss the options and any potential fees.

Which insurance providers offer monthly payment plans for Super Visa insurance?

Insurance providers that offer monthly payment plans for Super Visa insurance include Secure Travel, 21st Century, Destination Canada and Travelance.

These companies allow individuals to spread out the cost of their insurance, making it more manageable for visiting parents and grandparents who require long-term coverage under the Super Visa program.

Do I need to buy health insurance to travel to Canada?

While it’s not mandatory to buy health insurance to travel to Canada, it is strongly recommended. Canada’s public healthcare system does not cover visitors. Without any form of coverage, you will have to pay a substantial amount of money for medical treatment while in Canada.

Having medical health insurance in Canada can provide coverage for all forms of emergencies, including hospital visits, and prescription medications, ensuring that you are financially protected during your stay.

Paying monthly for visitor insurance in Canada offers flexibility and budget management by breaking down costs into smaller, manageable payments. While this option avoids large upfront fees, it may come with higher overall costs and additional fees. Monthly payment for visitor insurance is beneficial for students, foreign workers, and returning Canadians, but ensure to compare providers and understand the terms. Some companies offer monthly plans, each with specific conditions.