Private health and dental insurance covers the cost of medication and medical treatments that universal health care in Canada does not. While provincial or territorial health plans typically cover essential medical services such as doctor visits, hospital stays, and surgery, extended health insurance expands the scope of coverage to include services like preventative care, follow-up treatments, and more.

Personal health insurance plans often include benefits such as:

Prescription Drugs

Antibiotics, narcotics, creams, etc.

Paramedical Expenses

Mental health services, physiotherapy, registered massage therapy (RMT), chiropractic, etc.

Medical Equipment

Crutches, nebulizers, CPAP machines, etc.

Dental Treatment

Teeth cleaning, braces, crowns, etc.

Vision Care

Glasses, contact lenses, eye exams, laser eye surgery, etc.

Travel Medical

Emergency medical expenses

Extended health insurance provides comprehensive coverage for prescription drugs, dental coverage, vision care, travel medical coverage, and more. Some private health insurance coverage may even include semi-private or private hospital rooms or access to virtual healthcare providers. These additional benefits can vary depending on the specific insurance plan and provider.

There can be annual maximums placed on each coverage type in the form of dollar amounts as well as percentages of the cost covered. For example, a plan might cover.

Generally, Canadian insurance companies divide their health coverage into three tiers: basic, mid-tier, and enhanced. Higher tiers offer more comprehensive coverage, but cost more than basic plans.

The kind of coverage may vary between providers, but standard plans for each tier typically offer:

Basic Plan

Mid-Tier Plan

Enhanced Plan

Some providers offer direct billing, meaning that the medical services provider bills them directly for their portion of the cost. Other providers may require you to pay the entire bill upfront and they will reimburse you after you submit your claim.

Learn more about health insurance coverage

Call 1-888-601-9980 to speak to our licensed advisors right away, or book some time with them.

The cost of personal health insurance in Canada depends on your personal health history and your plan's coverage details. For example, if you have pre-existing medical conditions and have complex medical needs that require coverage, your plan will be more expensive. To get an accurate price for your individual health insurance plan, at the time of application, the insurer will want to know…

About you…

About your plan…

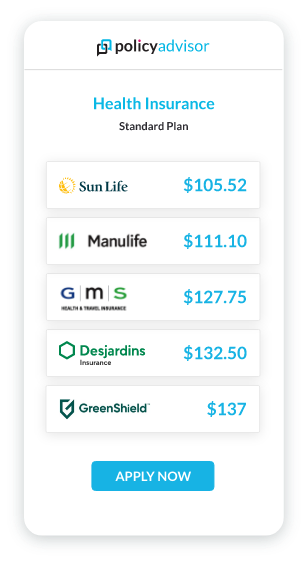

The price you pay will differ from the price your neighbour pays—the plan and the cost are unique to you. But let's give you an example quote as a baseline.

Basic Plan

$80/month

Standard Plan

$100/month

Enhanced Plan

$120/month

*Quote for a 35-year-old male, non-smoker, with no health risk or pre-existing conditions, who lives in Ontario.

Yes! Even with your government health plan, your medical costs can start to rack up — especially for routine checkups like dental cleaning or eye exams (not to mention if you have kids)! On top of covering the immediate expenses that come after a health event, like medication or rehabilitation, extended medical insurance can also cover preventive care and maintenance health care services like:

|

Physiotherapy |

$75-$100/hour |

|

Registered massage therapy |

$80-$150 |

|

Braces |

$5,000-$6,000 |

|

Prescription Glasses |

$40-$1,000 |

With private health insurance, you can rest assured that your family can afford care without dipping into your savings if something happens.

Anyone who wants a portion of their medical costs taken care of in a way that lets them balance their budget needs personal medical insurance. Provincial plans will cover some eligible expenses, but extended health insurance will cover the rest.

Sometimes you have health care coverage through your work or group plan. But that's not always the case. You need extended health and dental if you are…

Business owners/Self-employed

If you own a business, or you’re self-employed or a side hustler, you should get individual or group health insurance to keep yourself and your employees in peak condition.

Retired

Your employee benefits plan may have covered you in your working years, but now that you're retired and off the payroll, you will need your own extended health plan.

Families

Medical costs for a family with dependents can add up quickly (like when one kid needs braces and the other needs glasses). Health insurance can help families afford those costs.

Universal health care in Canada provides coverage for basic medical care like doctor's visits, hospital stays, and surgery. It may also cover some medications/treatments administered in the hospital. However, thousands of other out-of-pocket expenses come with medical, dental, and vision care that are not covered by the government health insurance plan.

| Universal Health Care | Private Health Care | |

|

Doctor's Visits |

|

|

|

Surgery costs |

|

|

|

Hospital stays |

|

|

|

Prescription drugs |

|

|

|

Mobility equipment |

|

|

|

Dental care |

|

|

|

Vision Care |

|

|

|

Emergency travel medical |

|

|

|

Therapy |

|

|

|

Chiropractor |

|

|

|

Physiotherapy |

|

|

|

Massage |

|

|

We work with Canada's best health and dental insurance providers. Each provider has different plans and different prices--our expert advisors at PolicyAdvisor can find the best health plan option for you!

To apply for health and dental insurance, start with our online quoting tool — it takes just a few minutes to find a great plan!

Answer a few simple questions about your health and what coverage you're looking for. We'll shop the health insurance market to find the best prices for your health and dental insurance!

Maybe! If you already have employee health benefits, you may not need additional health insurance. However, be sure to check your policy details. Sometimes there are heavy coverage restrictions on group plans. With your own personal health insurance, you get to decide your coverage plans and how much you pay.

Yes, you can get health insurance if you have an existing health condition. When you apply for coverage, you'll be asked about any pre-existing conditions. These are health conditions that you have been diagnosed with before applying for health insurance. Pre-existing conditions can be covered even if you apply for a plan within 90 days of losing your employee benefits coverage through your work, for example. But the plan may be more expensive in this case. People who have a pre-existing condition may also consider guaranteed acceptance plans, which don’t have a medical questionnaire. But these are more expensive than standard plans as well.

Medical insurance covers out-of-pocket expenses for standard injuries and illnesses that are not covered by your provincial health plan. It will pay a portion of these expenses (usually 70% to 90%).

Critical illness insurance, on the other hand, is a one-time payment to you if you are diagnosed with a critical or terminal illness. For example, if you are diagnosed with cancer, critical illness insurance will give you a one-time payment that you can use however you wish. It can cover things like travel costs to specialized treatment facilities or an extra special family vacation. Extended medical would cover your cancer surgery and a portion of your cancer treatment in this scenario.

Extended health insurance covers out-of-pocket medical expenses that occur in your day-to-day life in Canada. This may include prescription drug coverage, coverage for vision care, and more. Travel medical insurance covers you for any unexpected medical expense you incur while traveling outside of your home province or country. For example, if you need ambulance services during your trip to the US.

Sometimes, it depends on the type of therapy and what kind of plan you have. Extended benefits usually cover paramedical expenses such as physiotherapy, chiropractic, and psychological services, including therapy. Always check your policy wordings to see how much coverage you get each year, if the coverage is capped at a maximum percentage or dollar amount per year, and if your coverage includes psychologists and/or psychotherapists. Be aware that some providers may require a doctor's recommendation for paramedical claims.

Yes. Health insurance commonly includes dental coverage in their mid-tier and enhanced plans. Some companies also offer dental benefits as an add-on coverage.

Read more about private dental insurance.In many provinces, vehicle insurance has accident benefits that cover the cost of therapies and medical treatments associated with the accident. However, that coverage is very limited.

For example, the accident benefits may only provide 3 sessions of physiotherapy, but the whiplash sustained in the accident requires you to have more sessions to regain mobility. This is where your extended health benefits would come in; they could help cover the cost for the remaining sessions (up to policy maximums).

Some companies will require that you pay for the medical expenses first and then they will reimburse you once you've made a health insurance claim. Other companies will allow the health care provider to directly bill them (direct billing), so the insurance company will cover the 80% and you pay the 20% at the till. Each plan is different, so it's important to check your private health insurance policy details.

Health insurance claims are filed directly with your provider. Most insurance providers have online submission forms you can fill out on their website, or printable forms you send them by mail. You will need the receipt as proof of the medical bills you paid, although some companies only require you to hold onto the receipt in case there is any claim dispute.

Some providers also do direct billing, meaning that you don't have to pay upfront. The insurance company is directly billed at the point of the transaction.

Learn more about the process of submitting a health claim.