Life insurance is an agreement between you and a life insurance provider. If you die, they will pay a death benefit. In exchange, you agree to periodically pay them an insurance premium.

Both you and the insurance company will agree on the amount of death benefit and premiums owed and the timeframe of this agreement. You can also choose optional add-ons called riders which adjust the coverage to fit your needs.

It is a form of financial security you use to ensure those you leave behind are taken care of in your absence. Your beneficiary can use the death benefit however they need. Whether that’s helping with the cost of living and raising a family, paying off outstanding debt and mortgages, or taking the time to properly grieve, life insurance can help your loved ones through rough circumstances.

Life insurance is not something you buy for yourself. You purchase a life insurance policy for your dependents so that they can have the financial freedom you want them to have, whether or not something unfortunate happens to you.

With this goal in mind, life insurance is extremely customizable, with many providers offering different policies to fit the vast spectrum of life insurance needs in Canada.

Learn more about how life insurance works

Life insurance can be broken down into two main policy types in Canada: term life insurance and whole life insurance. Besides these two main life insurance options, there are other types of life insurance policies with very specific use-cases, such as universal and Term-to-100 insurance.

Term life insurance covers you for a fixed period of time such as 10, 20, or 30 years, or until you reach a set age, like 65 years old. You pay premiums periodically during that term and should you pass away, your beneficiaries will receive a tax-free lump sum payment that you determined when you first started your policy. If you outlive the term, there is no payout, and thus this form of life insurance coverage is less expensive than permanent alternatives.

Learn more about term life insuranceWhole life insurance covers you for your entire life, rather than a set term. These policies are sometimes called permanent policies. You pay premiums periodically until your death OR until you surrender the policy for its accumulated cash value. Because the policy never expires and there is an added savings or investment component, the monthly premiums for whole life insurance are significantly higher than those for term life insurance.

Learn more about whole life insuranceUniversal life insurance is similar to whole life insurance, except there is a self-directed long-term investment component. Your insurer gives you options for investing the cash value of your policy. Universal life insurance plans require more hands-on activity than other life insurance coverage options.

Learn more about universal life insuranceThis is type of insurance is a whole life policy that doesn’t have a cash-out option. It only pays upon your death (making it a little cheaper). It offers a bridge between term and whole life insurance. Plus, if you make it to 100 years, you are no longer required to pay premiums and still retain the coverage.

Learn more about term-to-100 life insuranceBetween term life and whole life insurance, there is no such thing as better. Each coverage has specific uses for protecting your loved ones, securing your finances, and planning your estate.

| Term Life Insurance |

VS |

Whole life insurance |

|---|---|---|

| Generally, term life insurance is a more cost-effective choice when you are young and your needs are large but mostly temporary (like raising children or covering your mortgage debt). | In contrast, whole life insurance policies provide lifelong coverage as long as you pay your premiums and are great for estate and final expense planning. | |

| Temporary coverage for a fixed period of time | Guaranteed lifelong coverage | |

| Best suited for temporary needs (mortgage, children’s education, lifestyle protection) | Best suited for permanent needs (estate planning, retirement income, final expenses) | |

| Offers death benefit but does not build any cash value | Offers death benefit and access to a growing cash value | |

| Death benefit is fixed when policy is purchased and doesn’t change | Death benefit may increase with dividends | |

| Loans/withdrawals cannot be taken against the policy | Policy loans can be taken and dividends may be withdrawn | |

| Benefits will be received only at policyholder’s death | Benefits may be received during lifetime as dividends or loans |

Call 1-888-601-9980 to speak to our licensed advisors right away, or book some time with them.

Life events create the need for life insurance. If you've recently purchased a home, had a child, or have experienced other major financial changes in your life, you will want to make sure that your family is protected.

Whether you are single or in a relationship, life insurance is important. When you pass away, your loved ones may have to cover your funeral expenses and pay off any financial liabilities you have, such as your debts or mortgages. If you have insurance coverage, your debts will not be a burden for your family members.

If someone else depends on your income for their quality of life, it’s a safe sign you may need life insurance. Commonly, life insurance is needed for homeowners, couples, parents, business owners, and more.

The main reasons Canadians purchase a life insurance policy

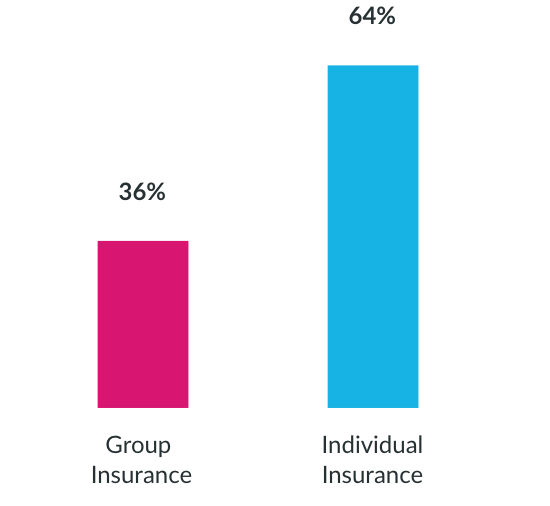

While group plans are affordable, convenient, and require limited to no underwriting, they offer limited coverage, a lack of control, and severely limited portability (meaning, if you lose your job or change jobs, you most likely lose your coverage or face a pricey conversion option).

Almost 36% of life insurance owned by Canadians is through a group term insurance policy they have through their work or professional association. Thus, a large number of Canadians are under the impression that they are covered for whatever life throws at them.

Unfortunately, the majority of Canadians may find themselves with a gap in coverage if they examined their plans versus their needs.

Most Canadian workplace benefit plans offer 1-2 years maximum as a death benefit. As you’ll read below, most Canadians with dependents would need substantially more coverage to adequately provide for those they leave behind should something unfortunate happen to them. In fact, 54% of Canadian adults have life insurance that only covers 2 years or less of their salary, and over 90% still face an insurance shortfall.

Learn more about life insurance through group benefitsCompare Life Insurance Quotes

30 Companies, 20,000 Options,

1 Way to Compare and Save

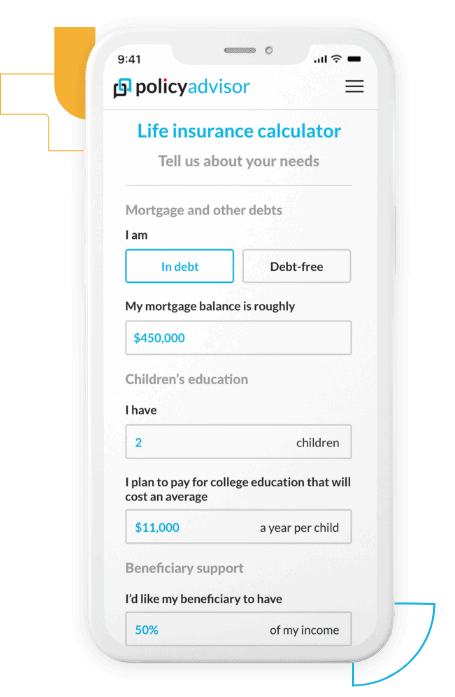

The sweet spot for how much life insurance you need may not be obvious. You don’t want to choose so little as to not cover any outstanding debts as well as the cost of living for those you leave behind.

At the same time, choosing an amount that’s too large may prove costly for the premiums you pay while you are alive. What if you realize you may not have needed that much insurance coverage and could have saved some money?

A common rule of thumb is to choose 8-10 times your yearly income as your death benefit.

For a more precise answer, take into account any debts you have, your family’s living expenses, future education needs of your children, plan for end-of-life expenses and any other allocations (e.g. charitable donations) you may want to make.

Below are the things to consider when figuring out life insurance needs:

Life Insurance Calculator

Get the most accurate estimate for your life

insurance needs.

Several factors determine the cost of life insurance, but they can be divided into 2 buckets: personal (your health status and other factors unique to you) and policy (the type and amounts of coverage you choose).

Personal factors

Policy parameters

Insurance companies price their policies differently from one another based on their cost and return expectations.

For most young, healthy adults life insurance costs are quite reasonable on a 20-year term policy. However, 80 percent of millennials overestimate the cost of life insurance (by up to five times the actual price!). The reality is, rates can be as low as the cost of an extra-large pizza every month.

For instance, a 30-year old, non-smoking Ontario woman of average health, would only pay $21 per month for a $500,000 death benefit on a 20-year policy. The price for 20-year term life insurance will be even lower if she decreased that death benefit.

If you’re personalizing your Canadian life insurance policy so that it suits your specific needs and budget, life insurance can and should be affordable. To get an accurate picture of how much your life insurance options might cost for you, use our life insurance quoting tool. By answering a few questions you can get no-obligation quotes from 30 of Canada’s top insurance companies.

| COVERAGE AMOUNT |

TERM 10 YEARS |

TERM 20 YEARS |

| $250k | $11/mo | $14/mo |

| $500k | $15/mo | $21/mo |

| $1M | $23/mo | $36/mo |

The prospect of paying for insurance you may never use can sound unappetizing. These thoughts can be amplified with life insurance— not only may it never pay out (depending on if you have term or permanent coverage), but even if it does, you are not around to see it work.

While this thought exercise seems a little morbid, you have to think about your death to truly gauge whether life insurance is worth it to you. Taking care of your loved ones and having that peace of mind is one of the major benefits of life insurance. It’s not about you, it’s about them.

Solid end-of-life planning (including life insurance) has a significant and positive effect on your loved ones in the case of your premature death. But life insurance may not be a priority for everyone at every stage of their life depending on what they can afford. It can be a costly mistake for those that miscalculate the amount or type of coverage they need.

Life insurance is worth it if you have the right amount of coverage in place for you and your family’s needs.

PolicyAdvisor helps Canadians find the best life insurance policy for their needs. But let’s be frank. There is no best insurance provider. There is – however – the best insurance provider for you.

The country’s top insurance companies offer unique policies to fit every Canadian’s individual coverage needs. What helps is having the choice and knowledge to pick the policy and provider that’s right for your situation.

That’s why PolicyAdvisor partners with 30+ of Canada’s top insurance companies – the most by any online broker. We make sure you have the greatest number of options when choosing the insurance company to protect yourself and your loved ones.

We can help you obtain a life insurance plan from Assumption Life, BMO Insurance, Canada Life, Canada Protection Plan, Desjardins, La Capitale, Empire Life, Equitable Life, Foresters, Humania, iA Group, ivari, Manulife, RBC, Sun Life, SSQ, and Wawanesa.

Compare Life Insurance Quotes

30 Companies, 20,000 Options,

1 Way to Compare and Save

Yes, you can get an insurance policy without a medical exam in Canada. Given the recent global pandemic and a greater focus on physical distancing, many are uncomfortable with the thought of going to a crowded lab for medical tests or inviting a stranger into their home for a medical exam. Luckily, there are several options for life insurance coverage without a medical examination or bloodwork.

PolicyAdvisor offers several ways for one to apply for life insurance without a face-to-face meeting. Besides an aversion for blood tests, there are several other reasons someone might elect for non-medical life insurance. If you have been declined for coverage in the past, or simply need coverage faster than medical underwriting will take to complete, a simplified or guaranteed issue insurance policy provides more options and you may only have to answer some simple medical questions.

You can shop for quotes, speak to a licensed Canadian online insurance broker, and apply for life insurance all without leaving your own home or having a face-to-face meeting.

Quite often the answer is yes. There are several reasons why your group coverage may be lacking: the benefit may not cover your needs adequately, the coverage isn’t portable with you and you have little control over the insurance policy offered to you.

Individual term life insurance is more flexible and offers protection in ways group life insurance coverage cannot.

Learn more about why you may need private supplemental term life coverage here.Mortgage insurance vs life insurance is an argument we see a lot. Protecting your mortgage through a term life insurance policy is often the best choice for Canadians for many reasons, and offers many advantages over mortgage insurance (also known as mortgage life insurance).

Learn more about mortgage insuranceWhile buying life insurance when you are single and healthy might seem counterintuitive, it might be the best time to purchase it. When you are young, single, and healthy you qualify for better rates due to a number of factors. That being said, depending on your situation it might not be the right time for you to start purchasing this affordable life insurance. Use our Insurance Checkup tool to see if there are gaps in your coverage and if you may need an insurance policy, and decide from there.

Anyone with dependents or loved ones needs life insurance, but due to their circumstances single parents often bear a greater responsibility in the raising and protection of their children and that extends to life insurance and financial protection.

Learn more about life insurance and single parentsYes, you can buy insurance for your loved ones but not without their consent or without their knowledge that their life is being insured. The only exception would be in the case of children below the age of consent where you are their legal guardian. In short, we’ll need to speak to anyone you intend to insure - including your loved ones.

Learn more about purchasing a life insurance policy for someone else.Health problems don’t necessarily preclude someone from purchasing life insurance, but they will most likely affect the price of premiums. Depending on the nature of your ailment, when it was diagnosed, and how it currently affects your health, our experienced advisors can help review coverage options and match you with a life insurance company with policies tailored to your situation. Our in-house insurance advisors help our clients apply for simplified non-medical insurance policies or guaranteed non-medical insurance coverage, wherever those are the best options for clients. Our expert advice is available whenever you need it.

Applying for life insurance online provides many advantages over the traditional process. First, you can apply from anywhere you have access to your phone, tablet, or computer. As well, you can get quotes from 30+ insurance companies and are not limited to those companies a traditional insurance agent represents. Lastly, you can compare insurance quotes and policies side-by-side to ensure you are getting the coverage you intended. All with consistent online support from expert Canadian advisors. Online life insurance, Canada – it saves you time and money.

At PolicyAdvisor you get free, instant, online, in-Canada life insurance quotes and can compare the market in minutes to make sure you get the best policy for your budget and needs.

Go to our online life insurance comparison tool and answer a few basic questions and you’ll be able to compare the best life insurance quotes and a life insurance policy from more than 30 of Canada’s largest life insurance providers. You can get a quote in minutes.

When comparing life insurance companies, we look at age, policy details, price, financial strength, annual assets, and annual premiums.

Currently, there are 3 provinces we service applications for life insurance; Ontario, Manitoba, and Alberta.

Learn more about our criteria and the biggest life insurance companies in Canada.