Compare Canada’s Best Travel Insurance

Apply online and save BIG

Apply online and save BIG

Canadians are choosing PolicyAdvisor to help them with all their travel insurance needs. Whether vacationing abroad or visiting Canada temporarily, our advisors can help you find the right coverage.

Travelling Canadians

Cover unexpected medical expenses when you travel abroad

GET QUOTESVisitors to Canada

Comprehensive emergency medical coverage for a visit to Canada

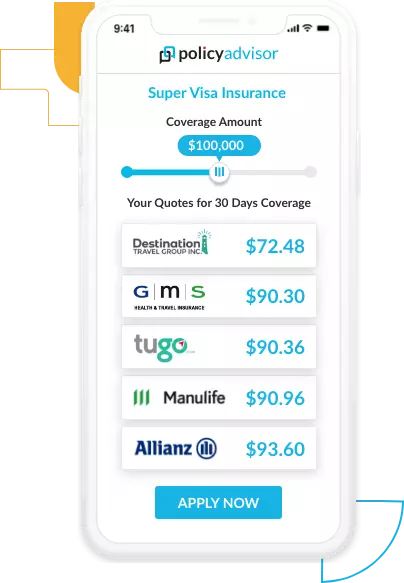

GET QUOTESSuper Visa Insurance

Coverage that fits the requirements for those applying for a Canadian super visa

GET QUOTESSnowbirds

Cover your time away as you escape from Canada's winter

GET QUOTESInternational Students

Coverage for international students attending school in Canada or Canadians studying abroad

GET QUOTESForeign Workers

Coverage for those working in Canada before they are eligible for provincial health plans

GET QUOTES

Travel insurance is a type of insurance that helps to cover the cost of medical care if you become sick or injured while travelling. It can also protect you from financial loss if you have to cancel or interrupt your trip.

There are two main types of travel insurance: travel medical insurance and trip cancellation/interruption insurance.

Travel medical insurance can help to cover the cost of medical care if you become sick or injured while travelling. It can also help to cover the cost of travel if you need to be transported to a hospital in another country. This is the most common type of travel insurance.

Trip cancellation/interruption insurance can help to reimburse you for the cost of your trip if you have to cancel due to an unforeseen circumstance, such as illness or bad weather, or other situations that may delay or cancel your trip (lost baggage, transportation delays, etc).

If you are planning a trip from your home in Canada, or planning on travelling to Canada, it is important to ensure you have travel insurance before you depart. This will help to protect you from unexpected costs if something goes wrong on your trip and give you peace of mind such accidents or delays will not be a financial burden.

Learn more about travel insurance

Call 1-888-601-9980 to speak to our licensed advisors right away, or book some time with them.

There is a wide array of insurance needs for both those visiting Canada, and travelling away from it. They include:

Inbound travellers

Outbound travellers

Depending on where you call home, and the reason and length of your travel, there are several different kinds of travel insurance available.

Travelling Canadians

Residents of Canada need travel insurance for trips abroad. While you public healthcare or group health insurance covers medical emergencies at home, an accident or medical emergency while you are out of country can be very costly.

Read moreVisitors to Canada

Those visiting Canada from outside the country also need travel medical insurance. While Canada does have a robust public healthcare system, these services do not extend to non-residents of the country. If you are ill or injured during your trip to Canada, you will be responsible for the costs of doctor's visits, emergency care, prescription, and more.

Read moreSuper visa insurance

Parents and grandparents or Canadian citizens and permanent residents are eligible for a special Canadian visa called the super visa. This visa allows them to enjoy an extended stay in Canada for as long as 2 years. A mandatory stipulation of super visa approval is holding a medical insurance policy to cover and illnesses or accidents that can occur during this trip. Super visa insurance is a widely available insurance policy that caters to the specific needs and requirements for super visa eligibility.

Read moreSnowbirds

Snowbirds are retired Canadians who spend the winter season abroad to avoid Canada’s colder months. As a snowbird, it’s important to make sure you have the right travel insurance in place before you head south for the winter, as you will not qualify for public health insurance at your destination.

Read moreInternational Students

International students often need emergency health insurance wherever they choose to complete their studies. This includes both Canadians studying abroad and students completing their education in Canada. Emergency travel medical insurance ensures one can focus on their studies knowing they won’t have to deal with an unforeseen medical bill.

Read moreForeign Workers

Foreign workers visiting Canada for temporary or permanent employment will not have immediate access to public health care. Travel medical insurance will cover you if you get sick or injured while working in Canada.

Read moreCompare Travel Insurance Quotes

30 Companies, 20,000 Options,

1 Way to Compare and Save

At PolicyAdvisor, we partner with the country’s best travel insurance providers to present you with the most choice and best option for your insurance needs. Whether you are vacationing abroad, visiting Canada for an extended trip, or sponsoring a super visa application for a loved one, we’re here to help guide you to best provider.

Some of our partners include:

Travel Insurance Quotes

Get instant quotes from Canada’s top travel,

insurance companies

Whether for a vacation abroad or a visit to Canada, travel medical and health insurance is very important.

For Canadian travelling abroad

For those visiting Canada

The cost of travel insurance is determined by many variable factors including the type of insurance you purchase, your age, the duration of the trip, and the amount of coverage you are getting. A rule of thumb is travel insurance should typically cost 5% of your trip. Of course, these costs can increase for extended stays like super visa insurance, insurance for snowbirds, and insurance for students or foreign workers.

While knowing there is a built-in insurance component to your credit card provides great peace of mind, it sometimes falls short of comprehensive travel coverage. Insurance from credit cards usually has a cap on the amount of coverage it provides and is not intended to cover you for medical emergencies that may occur on an extended trip. Moreover, credit card travel insurance is also limited in that its coverage typically only extends to those parts of your trip you paid for using that credit card.

An independently purchased travel insurance policy ensures you are covered for your entire trip and whatever may happen during its duration.

Most travel medical insurance policies do not cover a pre-existing medical condition by default.

In some cases, if you have shown no symptoms or diagnosis of a pre-existing medical condition for 180 days prior to the effective date of the policy and have not had treatment for the condition during that time, it will not be considered a pre-existing condition during your coverage period.

As well, some conditions may get excluded from your travel medical insurance coverage during the underwriting process. A pre-existing condition exclusion could include a heart condition, kidney condition, form of dementia,

Lastly, some providers offer policies that will cover pre-existing conditions, though the premium will be higher to compensate for the added risk.

You can typically get a refund for a travel insurance policy as long as you cancel the coverage before the departure date of your trip.

Most travel insurance is not mandatory, though encouraged as foreign medical expenses can add up quickly. Without travel medical insurance you are personally responsible for any medical expenses you incur during your time away from your home country.

Some travel insurance policies are mandatory. For instance, super visa insurance is mandatory for super visa applicants to get approved for their policy, and an in-force policy is compulsory for the duration of your stay in Canada using the super visa.

No, a public healthcare plan from your province or territory does not cover medical emergencies that happen outside of Canada. Much like how Canada’s public healthcare does not cover those who do not reside in Canada, the healthcare in countries outside of Canada has no reciprocal agreement to treat travelers. Canadians are expected to pay out of pocket for any health or medical procedures they need when outside of Canada.

Thus, it is important to have an in-force travel medical insurance policy when travelling outside of Canada and your home province.

Yes, it is possible to get some coverage, though there will most likely be exclusions on your policy. Many providers in Canada or abroad will offer you emergency medical travel insurance if you have already left Canada but wish to purchase coverage.

However, the policy generally will not be active until 48 hours after you purchase the coverage. This waiting period is designed to prevent someone from acquiring a policy after they have been injured or hospitalized with an illness.

If you travel abroad often (more than twice per year) it may be worthwhile to purchase an annual travel policy. Many providers offer annual options for their travel medical insurance policies, which can save you money on premiums and eliminate the need to arrange separate insurance policies for each trip you take or each leg of a multi-trip journey. Many Canadians travel during winters to warmer climates (snowbirds), it is advisable to buy multi-trip / annual travel insurance for such needs. Speak with our advisors to see if an annual travel insurance policy makes sense for your plans.