Compare the Best Visitor Insurance Plans in Canada

Apply online and save BIG

Trusted by Canadians

The Gold Standard

They are the Gold Standard of Client Experience. The whole process was simple, hassle-free, uber transparent and all of this at no cost. Our advisor’s knowledge and attitude reeled us in from the first call. We felt as if we were premium clients.<...

Lipika

Knowledgeable and helpful

Very knowledgeable and helpful in determining the best plans for my son and I and he took the stress out of the process. Fully explained all of the options available to me, and answered all of my questions. I know that I made an informed decision ...

Franz T

Skeptical to believer

First I was skeptical about high reviews but anyways PolicyAdvisor. I could see that they are trying to give best details they have and guide us to choose policy rather than selling it. Rarely I type in reviews. I can say that PolicyAdvisor is wor...

Meenakshi N

Excellent service

Thank you for the excellent customer service. You’ve been very supportive in all our questions. After the video call, he didn’t really push to sell. We appreciate your time, and support in giving us updates and follow-ups and phone calls until we ...

Jessa Y

Genuinely Cared

My advisor genuinely cared about making sure I was comfortable and informed throughout the process, and patiently answered my many questions. He also always followed up to make sure I was up to date on my application process.

Jessica F

Simpler than expected

Answer all our questions in a timely manner, and the process was much more simple than I was expecting. We had our life insurance sorted and approved within a few days. I really like that they did the comparisons of policies for us.

Joanne V

Life Insurance made easy

Was looking for a life insurance policy and the search was exhausting by conventional means, until I found PolicyAdvisor. My representative was excellent, and explained all my options and preferred quotes. Life Insurance made easy, thank you all a...

Pedro

Unbiased advice

If you’re looking for best rate and an advisor, I would highly recommend PolicyAdvisor. They are expert in finding the best insurance provider. They are reliable and give unbiased advise. I’m glad I came across Policy Advisor online as they helped...

Zeny D

A walk in the park

I was able to derive a personalized quote within a minute. From there on it was as smooth as taking a walk in the park. I did not have to wait in long lines, could chart my progress, and had full control of my application.

Mayank

Super easy

I’d previously reached out to one of the big insurance companies directly but found them so unresponsive and uninterested. I’m glad we found PolicyAdvisor. They made comparing options easy so we found something that worked for our need...

Lindsay

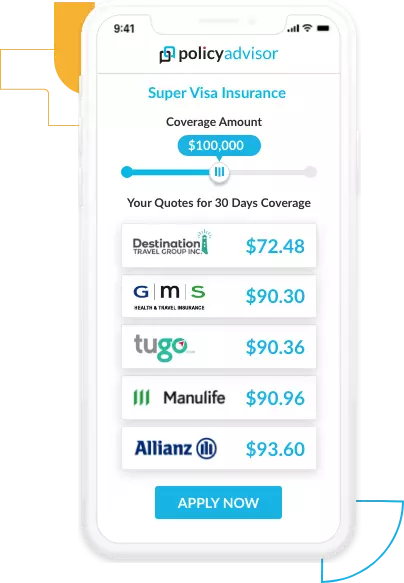

Get affordable visitor insurance to Canada

Compare the best travel insurance for visitors to Canada. Our licensed advisors will help you get instant quotes for Super Visa insurance, emergency medical coverage for parents, students, and tourists.

Super Visa Insurance

Coverage that fits the requirements for those applying for a Canadian Super Visa

International Students

Coverage for international students attending school in Canada or Canadians studying abroad

Foreign Workers

Coverage for those working in Canada before they are eligible for provincial health plans

Travellers from Canada

Coverage for travelling Canadians and snowbirds when they are abroad

Recognized as a leader in the industry

What is visitor to Canada insurance?

Canada’s provincial healthcare does not cover visitors, making health insurance for visitors to Canada a crucial form of coverage. Visitor to Canada insurance protects your parents, relatives, and other visitors from unexpected medical emergencies and travel-related costs while in Canada.

There are two main types of visitor insurance: medical insurance for visitors to Canada and trip cancellation/interruption insurance.

Medical insurance for visitors to Canada can help to cover the cost of medical care if you become sick or injured while travelling. It can also help to cover the cost of travel if you need to be transported to a hospital in another country. This is the most common type of visitor insurance.

Trip cancellation/interruption insurance can help to reimburse you for the cost of your trip if you have to cancel due to an unforeseen circumstance, such as illness or bad weather, or other situations that may delay or cancel your trip (lost baggage, transportation delays, etc).

What is Super Visa insurance?

Super Visa insurance is a special type of travel insurance that’s only available to the parents and grandparents of Canadian citizens or residents who are staying in the country for a long period of time. It will cover any medical emergencies that may happen to your relatives during their stay.

The minimum requirements a Super Visa insurance policy has to meet are:

- Must be valid for at least one year from the date the visa-holder arrives in Canada

- Must have at least $100,000 CAD in coverage

- Must cover emergency medical care, possible hospitalization, and repatriation

- Must be active and available for review by an immigration official each time the visa-holder enters Canada

- Must have been bought from a Canadian insurance company

2025 Update: New Super Visa Insurance Requirements

As of January 2025, Super Visa insurance must meet these updated standards:

- Minimum coverage of $100,000 remains unchanged

- Mental health emergencies must now be covered

- Coverage must include extended rehab services

- Telemedicine consultations are now eligible

- Pre-authorization rules streamlined for faster claims

- Policies from OFSI-authorized non-Canadian insurers are now accepted

Looking for affordable visitor insurance?

Call 1-888-601-9980 to speak to our licensed advisors right away, or book some time with them below.

What does visitor insurance cover?

Visitor insurance to Canada covers emergency medical expenses, hospital visits, prescription drugs, and more. Non-residents in Canada can use visitors to Canada insurance coverage to visit a hospital, emergency room, and walk-in-clinics. Here’s a list of all the inclusions in a medical insurance plan for visitors to Canada:

- Physician consultations: Reasonable and customary charges for medical care received from a physician, whether in or out of the hospital

- Prescription drug coverage: Health insurance can cover the cost of prescription medications that may be needed during your stay

- Pathological tests or diagnostic procedures: Diagnostic procedures including blood work, X-rays, CT scans, MRI, and more

- Paramedical services: Services provided by licensed professionals such as physiotherapists, chiropractors, podiatrists, or massage therapists

- Pre-existing condition coverage: Coverage for pre-existing medical conditions that are declared during the application process

- Repatriation: Insurance can cover the costs of emergency medical evacuation back to your home country, which can be a significant cost without coverage

- Accidental death and dismemberment (AD&D): Visitors to Canada insurance may also provide a one-time lump sum amount in case of severe accidents that may lead to the death or loss of limbs of the insured

- Emergency dental care: Some insurance plans provide coverage for emergency dental treatment or surgery that may have resulted from an accident or sudden injury

- Ambulance transportation: Visitors’ health insurance covers the costs of ambulance services—whether ground or air— needed to transport the visitor to the nearest hospital or medical facility during a medical emergency

- Hotels, meals, taxis: If a medical emergency requires a visitor to extend their stay in Canada for treatment or recovery, the insurance can cover additional expenses for hotels, meals, and local transportation such as taxis

- Childcare: In the event that a visitor is hospitalized and unable to care for their dependent child, the visitor to Canada insurance may cover temporary childcare expenses

- Trip break/Side trip: Some emergency medical insurance plans for visitors offer flexibility with a trip break or side trip coverage, which allows visitors to return to their home country for a short period or travel to another country without losing their insurance coverage

What are the types of medical insurance for visitors in Canada?

Explore comprehensive visitor medical insurance options for visiting parents, friends, family, students, and foreign workers.

Visitors to Canada

Canada’s robust public healthcare system does not extend to non-residents of the country. Those visiting Canada from outside the country also need visitor medical insurance to cover the expensive costs of a doctor’s visit, emergency care, prescription, and more if you fall ill during your trip.

Super visa insurance

Canadian citizens and permanent residents can get a super visa for their parents and grandparents to visit them in Canada for as long as two years. A mandatory stipulation of super visa approval is holding a medical insurance policy to cover illnesses or accidents that can occur during this trip

International Students

International students often need emergency health insurance in whichever country they are studying in. This includes both Canadians studying abroad and students completing their education in Canada. Emergency visitor medical insurance ensures one can focus on their studies knowing they won’t have to deal with an unforeseen medical bill.

Foreign Workers

Foreign workers visiting Canada for temporary or permanent employment will not have immediate access to public healthcare. Visitor medical insurance will cover them if they get sick or injured while working in Canada.

Travelling Canadians

Residents of Canada need travel insurance for trips abroad. While your public healthcare or group health insurance covers medical emergencies at home, an accident or medical emergency while you are out of the country can be very costly.

Snowbirds

Snowbirds are retired Canadians who spend the winter season abroad to avoid Canada’s colder months. As a snowbird, it’s important to make sure you have the right travel insurance in place before you head south for the winter, as you will not qualify for public health insurance at your destination.

How much does visitor insurance to Canada cost?

The average cost of visitor health insurance for travelers to Canada typically ranges from $50 to $400 per month, depending on factors such as age, duration of stay, and the level of coverage chosen. For instance, younger travelers (under 30 years) may pay between $50 and $100 monthly, while those aged 70 years and older may see costs rise between $200 and $400 per month.

Several factors such as the tourist’s age, health condition, and trip details affect the cost of health insurance for visitors to Canada. Young and healthy visitors will have to pay lower premiums while those above the age of 65 will pay higher premiums. Similarly, a pre-existing condition will increase the cost of premiums.

The cost of visitor insurance to Canada depends on factors like:

- Age

- Type of coverage (emergency medical, trip interruption/cancellation, baggage loss, etc.)

- Trip length

- Medical history

- Amount of coverage

- Deductible

- Pre-existing medical conditions

The following table shows a comparison of visitor insurance in Canada monthly premiums, with and without pre-existing condition coverage

Visitor insurance monthly premiums: with vs. without pre-existing conditions

| Visitor’s age | Premiums without pre-ex |

Premiums with Pre-ex |

| 25 years | $72.30/mo. | $92.70/mo. |

| 35 years | $90.90/mo. | $100.20/mo. |

| 45 years | $101.70/mo. | $115.50/mo. |

| 55 years | $110.70/mo. | $129.60/mo. |

| 65 years | $133.20/mo. | $168.60/mo. |

| 75 years | $240.00/mo. | $328.80/mo. |

| 85 years | $405.00/mo. | $453.92/mo. |

Which company offers the best health insurance plans for visitors to Canada?

Several insurance providers such as Manulife, Tugo, Allianz, Travelance, 21st century, GMS and more offer health insurance for visitors to Canada. Different providers have different premiums, policy inclusions, deductibles, and coverages.

Some companies offer tiered visitor insurance plans, categorized as basic, standard, and enhanced or Plan A and Plan B. The different plan categories will be priced differently depending on the policy coverage.

At PolicyAdvisor, we partner with Canada’s best visitor insurance providers.

Choose a plan from Canada’s top insurance providers:

- Manulife

- Tugo (iA Financial Group)

- Group Medical Services (GMS)

- Allianz

- 21st Century Travel Insurance Limited

- Destination Canada

- Travelance

- Secure Travel

Why should you buy visitor insurance to Canada?

Visitors to Canada need medical insurance because public healthcare doesn’t cover non-residents visiting Canada. Without insurance coverage, you could face tremendously high costs for medical emergencies. The Government of Canada advises comprehensive travel insurance to avoid unexpected expenses.

An emergency visit to the hospital can cost anywhere between $1,000 – $1,200 for non-residents. MRIs can cost $1,500 or more, and a 24 hour stay in the hospital can cost $3,000 to $6,000. Without insurance, visitors could face significant out-of-pocket expenses for medical emergencies, hospitalization, or even routine care.

You need visitor insurance in Canada because:

- You are not covered under Canada’s public healthcare plans

- Treatment for medical emergencies and prescriptions are expensive and may require cash payments

- Your home country’s public health care offering generally does not cover trips abroad

- Medical insurance for visitors to Canada can cover a broad range of potential situations, including emergency room visits, transportation back to your home country, and prescription drug and dental costs

Frequently asked questions

- Non-emergency treatments

- Routine check-ups and preventive care

- Pregnancy-related care (unless emergency)

- Mental health treatment (except emergency - NEW coverage in 2025)

- High-risk activities without additional coverage

- Treatment related to alcohol or drug abuse

- Cosmetic procedures

- Some provinces provide health coverage after waiting periods

- Others require students to purchase private coverage

- Many schools require proof of insurance for enrollment

- Student insurance often includes mental health and sports coverage